Discover

Partner with business leaders to discover their opportunities and challenges.

Delivering value for insurance industry clients with more relevant and impactful insight and solutions to meet their strategic goals.

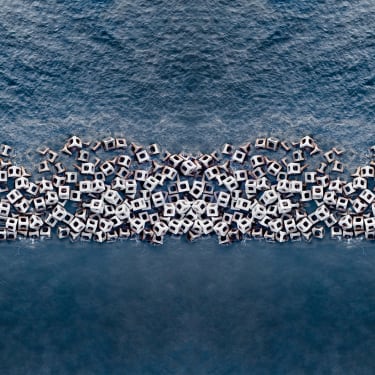

Insurers are at the heart of creating a more resilient world but face an increasingly dynamic environment with interconnected, emerging risks and fierce competition. Now more than ever, insurers require more holistic services and global insight to better understand and address their strategic, multi-faceted business needs across growth, capital, operational efficiency and talent.

Embedded in the insurance industry, we live its impact, complexities and potential - so we know how to listen better and interpret clients’ needs. We’re bringing together the best of Aon to support insurance industry clients with more relevant and impactful insight and solutions to meet their strategic goals and make better business decisions.

To navigate volatility ranging from climate to economic factors, insurers need to delve deep into understanding and mitigating the risks by enhancing their view of risk. Data, tools and analytics must complement broking and advisory capabilities to help protect and grow insurers’ businesses.

Develop a custom View of Risk to reflect your portfolio and align reinsurance with underwriting.

Better solutions to plan for climate change with access to cutting-edge climate science enable insurers to deliver innovative products, navigate volatility and remain profitable.

120+ Impact Forecasting catastrophe models to provide a fresh view of risk on peak and secondary perils.

Monitoring key metrics that impact ratings and strategies to enhance ratings.

Manage reserve risk, earnings volatility and risk tolerances while providing capital benefit in a cost-efficient structure through a loss portfolio transfer and/or adverse development cover.

In a riskier world where re/insurers look to bring new solutions to customers, capital can provide a bridge between innovation and investment. However, finding the right balance to optimize capital requires strategic decision-making to support growth and enhance both sides of the balance sheet.

Complement traditional and alternative capital with holistic advice on the most efficient sources.

Protect and grow your property business in response to changing risk and climate.

Manage the volatility of existing and emerging risks on insurers’ reserves.

Rather than working in silos, manage your risks across different classes and territories.

Capital optimization is key for achieving growth and return targets while managing stakeholder expectations.

Deploy capital efficiently and effectively across the enterprise with the Strategy and Technology Group.

To meet shareholder and societal demands while delivering sustained growth and profitability in a competitive landscape, insurers need the resilience and capacity to embrace increasing current and future risks.

Explore profitable opportunities, boost enterprise efficiency and drive financial health with our Strategy and Technology Group.

Insurers looking to grow faster and more profitably must align their business and talent strategies to drive innovation and build long-term customer relevance.

Optimize performance of people, process, technology and data to drive business outcomes.

As insurers adapt to rapidly shifting risks, they need to find new ways of working supported by a more resilient, flexible workforce with diverse capabilities.

In a volatile world, insurers need a strong, global client service and claims management partner to help deliver stability, competitive advantage and sustainable success.