How to Futureproof Data and Analytics Capabilities for Reinsurers

Now more than ever, the reinsurance industry needs insight. But it is still slow to implement advanced data and analytics.

Key Takeaways

-

Most reinsurers are 'spreadsheet nations,' lacking a defined strategy to deliver business results through analytics

-

Investing in data and analytics enables reinsurer outperformance through superior risk selection and portfolio optimisation

-

Developing a data and analytics strategy and roadmap are key to maximising the impact of investment

As reinsurers reassess their appetite in light of climate change, cat losses, inflation and other market shocks, they seek to make better-informed decisions that will help them develop cedent relationships, optimize their capital and drive superior returns.

The reinsurance industry needs data-driven insight more than ever, but it is still slow to implement advanced data and analytics (D&A). Time-consuming data-cleansing and out-of-date, generic management information is a reality for most reinsurers.

A recent study of reinsurer data and analytics conducted by Aon’s Strategy and Technology GroupOpens in a new tab found that most reinsurers are not realizing the potential benefits from the available data in submissions and third-party sources — concerning, for example, granular bordereaux reports. Many are still operating as “spreadsheet nations” with a heavy reliance upon Excel to support their pricing, reserving and capital modelling processes.

Reinsurers with more advanced D&A outperform the market by making better risk selection and portfolio management decisions at pace.

Looking to the future, reinsurer value propositions will expand beyond pure risk-transfer. Best-in-class reinsurers leverage technology to underpin robust analytics capabilities, offering cedents valuable insights in return for loyalty and better commercial relationships with the ceding insurers.

Understanding the Reinsurer Data and Analytics Landscape

Significant Opportunity for Improvement

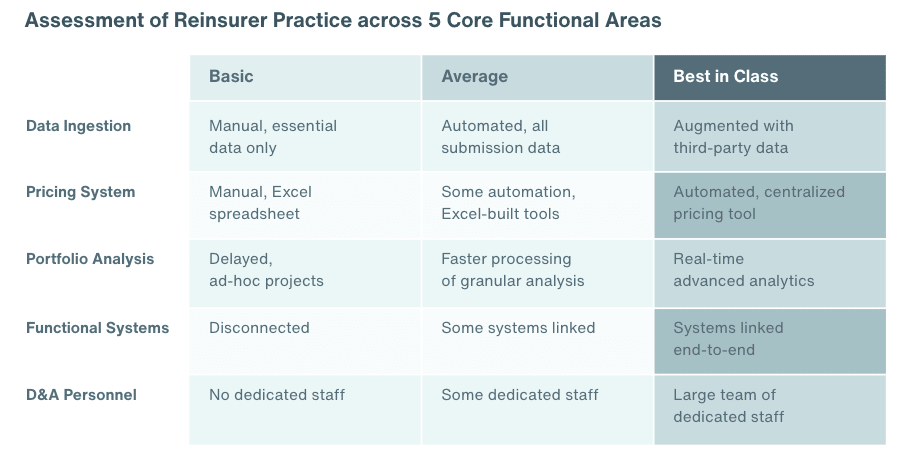

Table 1

Aon's Strategy and Technology Group analysis.

67%

Companies that experienced between 21 and more than 40 insider incidents in 2022.

Source: 2022 Cost of Insider Threats Global Report | Ponemon

A few companies in the market have started to move ahead of the pack through investing in targeted areas such as pricing systems or advanced analytics capabilities. Those reinsurers classified as “Best in Class” and “Average” by Aon’s Strategy and Technology Group make a "build-or-buy" decision either to develop proprietary pricing systems or license tools available in the market. Additionally, “Best in Class” reinsurers have invested heavily in building large, dedicated D&A teams which not only serve their own businesses but generate income through developing and selling D&A solutions to others.

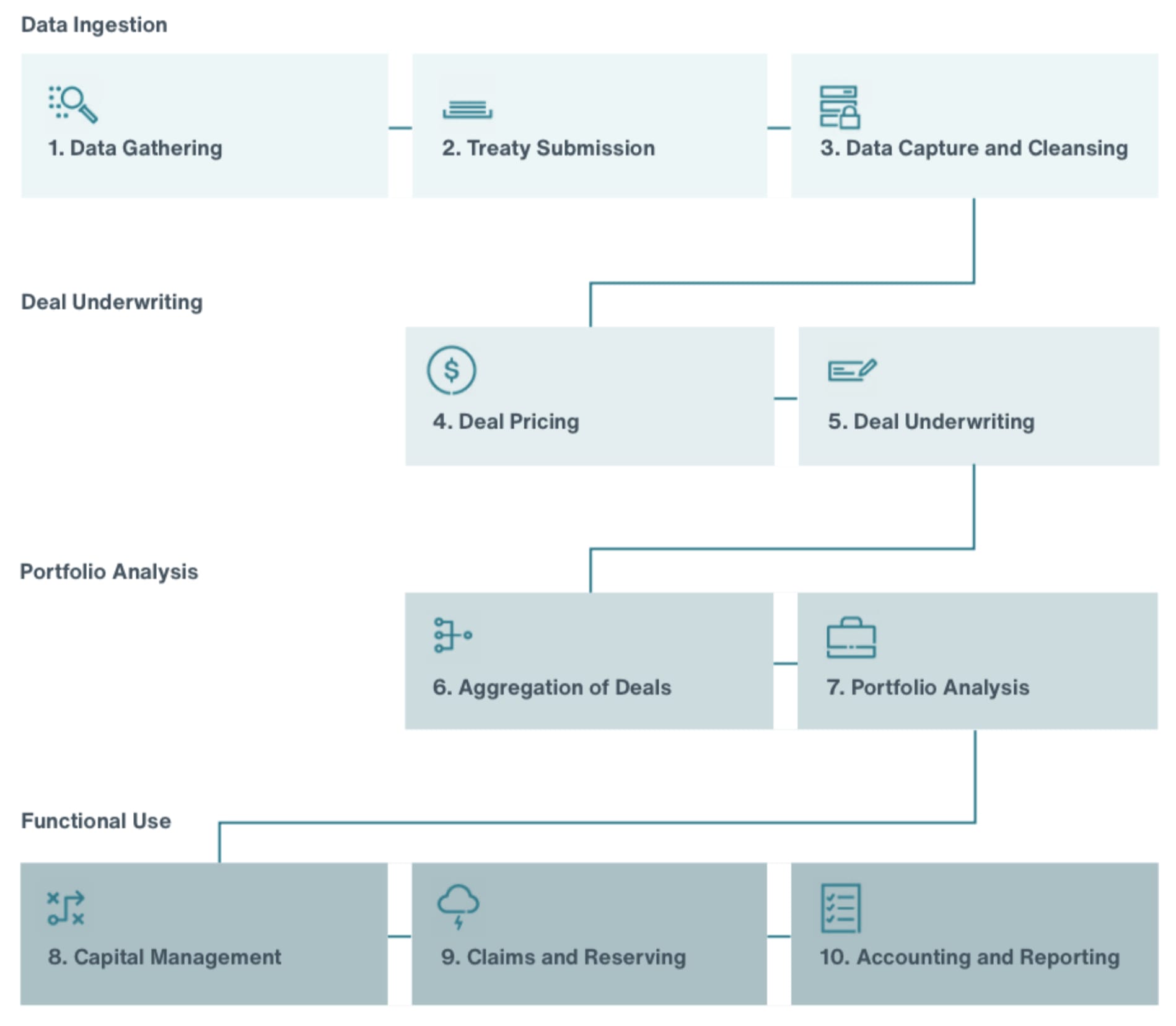

D&A Flow: Visualizing the Movement of Data

We have characterized how data moves between cedents, brokers and reinsurers as a 10-stage flow. There are significant inefficiencies across the flow with rekeying of data a major “time sink”.

Table 2

Aon's Strategy and Technology Group analysis.

44%

Increase in insider threats over last two years.

Source: 2022 Cost of Insider Threats Global Report | Ponemon

Deep Dive on 3 Areas of Data and Analytics

1. Data Ingestion: Optimizing Data Flows at the Source

One Insurtech executive has estimated that, alarmingly, some underwriters and actuaries can spend more than two-thirds of their time doing basic transformation and cleansing before they can use the data to make decisions. Differing standards in terms of the format, quantity, and quality of data in cedent submissions mean that vast amounts of manual work are required to bring the data into systems.

Additionally, much of the data is either “lost” and unusable, stuck on PDFs or huge spreadsheets with no efficient process to consolidate it into data systems. This leads to inconsistencies across the business, as individual teams use the raw data differently for their own processes — cleansing and standardizing the same data multiple times. The ability to capture and structure data accurately and efficiently at source will not only direct time that would otherwise be wasted towards value-add activities, but it is a pre-requisite for more advanced analytics. Best-in-class reinsurers invest significantly in developing a strong data culture, processes and partnerships to maximize the quality and scope of their data capture.

2. Systems and Methods: Integrating Systems for Effective Underwriting

Multiple disconnected systems are the norm across reinsurers. Often resulting from rapid growth or acquisition, these inefficient and cumbersome systems mean that data is typically scattered across the business. Individual teams create their own tools in Excel to store and analyze data which they then need to manually update. A lack of co-ordination between these teams gives rise to inefficiencies and inconsistencies across the business in addition to the risk that, without a central data repository and central control, the knowledge is lost when key personnel leave the company.

For reinsurers, there are two options for having an integrated pricing system: build or buy. Only the very largest reinsurers have the budget and scale of developer teams to build and maintain a pricing system in-house. For most reinsurers, the right option is to license integrated pricing systems off-the-shelf.

3. Advanced Analytics: Leveraging Data to Improve Risk Understanding

Once an efficient ingestion method and central system has been established with more granular data at their fingertips, reinsurers can conduct more sophisticated analyses to enhance their decision making. This includes sensitivity testing of parameters, portfolio optimization or marginal impact analysis on treaty deals. Most reinsurers can only perform a basic version of these portfolio analyses at a high level, months after a renewal period has concluded.

Sourcing and integrating third-party data — such as for example industry-specific inflation data — can also enrich the underwriter’s knowledge to enhance risk selection and better manage market cycles. Most reinsurers take a view on the current trends in the market to build into their view of risk via ad-hoc research projects. However, digitizing and centralizing analysis of market indicators using third-party data sources (both publicly available and licensed) would allow reinsurers to take a proactive approach to market cycle trends. This would enable reinsurers who do this effectively to react faster than their peers to market movements.

The Way Forward: Developing the Solution

1. Characteristics of a Best-In-Class Integrated Technology Solution

A best-in-class reinsurer will have multiple systems, typically licensed from the vendor market, and developed in-house. The architecture and selection of systems will vary, depending on the profile of the business they write and their in-house capabilities but will exhibit the following characteristics:

- There will be a configurable workflow to guide users efficiently through the underwriting process

- It will be supported through role-based access that is configured to in-house permissions

- Systems will be integrated, ensuring seamless data flow with no double-keying

- Data is stored securely in a schema that collects data consistently and comprehensively

- There will be flexibility to scale up or down the infrastructure to cope with peaks and troughs of usage, which is typically achieved using cloud computing

Reinsurers that have invested in improving their technology solution can take the next step in driving greater efficiencies and further automate their processes:

- Automated data-cleansing and formatting leveraging robotics

- Intelligent role-based workflows

- Automated documentation generation

- System integration, internal and external systems (e.g. connect to databases for sanctions checking)

- Automated data upload

- Dashboards and reporting layer build upon databases to analyze the portfolio, perform benchmarking etc.

2. Why invest in D&A as a reinsurer?

Developing best-in-class D&A requires investment. This will pay dividends for a reinsurer across four key areas:

- Improved risk selection: Capture more data and complement internal with external data to get more insights to improve your underwriting

- Improved efficiency in underwriting: Removal of manual tasks, freeing time for value adding activities such as writing new business

- Portfolio optimization: Improved data to support decision making on ideal business mix and the fine tuning of pricing, lines, and net positions

- Enhanced client proposition: Offering data driven services (in the longer-term) such as providing detailed exposure information to support risk selection, aggregation analysis, portfolio analysis and pricing

As an example, early investment in property catastrophe D&A enabled one data-driven reinsurer to take a differentiated view of risk, allowing it to build a market- leading portfolio.

The benefits are clear but the key to the success of the D&A journey is having a clear strategy and structured plan to drive progress forward. For basic reinsurers, the first step of the journey is to develop a comprehensive understanding of the current state of D&A and to define the future state with reference to best practice. These reinsurers can then identify providers to support the development of new integrated systems. For average reinsurers that are at a more advanced stage of development, data ingestion should become a key focus — both in third party and increasing capture from cedent submissions and then investing in developing advanced portfolio analytics.

About the Study

Aon’s Strategy and Technology Group conducted a study assessing the D&A landscape for reinsurers. The study was composed of significant secondary research element combined with extensive primary research including 25+ interviews with participants from across reinsurance value chain: brokers, actuaries, underwriters, data, and technology leaders and InsurTech founders.

About the Authors

Thomas Griffiths

Thomas Griffiths leads Aon's Strategy Consulting proposition for Reinsurers. He has nine years of experience advising reinsurance company management teams on a broad range of topics including: Market entry strategies, portfolio optimization, product development & innovation, growth strategies and operational improvement.

https://www.linkedin.com/in/thomas-griffiths-897b8579/

Jessica Cremin

Jessica Cremin is a Manager in the Strategy Consulting team within STG. She has nine years of experience working within the insurance industry, with four of those working for Aon advising insurers and reinsurers on their strategy. This has included working for several global reinsurers to advise them on the use of data and analytics in reinsurance.

https://www.linkedin.com/in/jessica-cremin-acii-37874656/

Jamie MacRitchie

Jamie MacRitchie is a Senior Associate in the STG’s Strategy Consulting team. Based in London, Jamie has more than five years of experience at various strategy consulting firms, working across industries and disciplines. Since joining Aon’s STG in 2021, he has worked with more than a dozen (re)insurers on projects spanning all areas of specialization within STG Strategy Consulting.

https://www.linkedin.com/in/jamie-macritchie/

General Disclaimer

The information contained herein and the statements expressed are of a general nature and are not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

Terms of Use

The contents herein may not be reproduced, reused, reprinted or redistributed without the expressed written consent of Aon, unless otherwise authorized by Aon. To use information contained herein, please write to our team.

Aon's Better Being Podcast

Our Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Aon Insights Series UK

Expert Views on Today's Risk Capital and Human Capital Issues

Construction and Infrastructure

The construction industry is under pressure from interconnected risks and notable macroeconomic developments. Learn how your organization can benefit from construction insurance and risk management.

Cyber Labs

Stay in the loop on today's most pressing cyber security matters.

Cyber Resilience

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Employee Wellbeing

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Environmental, Social and Governance Insights

Explore Aon's latest environmental social and governance (ESG) insights.

Q4 2023 Global Insurance Market Insights

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

Regional Results

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Human Capital Analytics

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Insights for HR

Explore our hand-picked insights for human resources professionals.

Workforce

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Mergers and Acquisitions

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

Navigating Volatility

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Parametric Insurance

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Pay Transparency and Equity

Our Pay Transparency and Equity collection gives you access to the latest insights from Aon's human capital team on topics ranging from pay equity to diversity, equity and inclusion. Contact us to learn how we can help your organization address these issues.

Property Risk Management

Forecasters are predicting an extremely active 2024 Atlantic hurricane season. Take measures to build resilience to mitigate risk for hurricane-prone properties.

Technology

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Top 10 Global Risks

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

Trade

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

Weather

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Workforce Resilience

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

More Like This

-

Article 8 mins

Florida Hurricanes Not Expected to Adversely Affect Property Market

Hurricanes Helene and Milton insured loss estimates are expected to fall between $34 billion and $54 billion. Healthy, well-capitalized insurance and reinsurance markets are positioned to absorb those losses.

-

Article 17 mins

Q3 2024: Global Insurance Market Overview

Buyer-friendly conditions continued across much of the global insurance market in Q3, painting a largely positive picture as we head into year-end renewals.

-

Article 10 mins

Why It’s Key to Conduct Cyber Due Diligence in Financial Services During Mergers and Acquisitions

A successful M&A strategy relies on due diligence across financial, legal, human capital, technology, cyber security and intellectual property risks. As cyber threats become more complex, robust cyber due diligence in private equity and acquisitions is increasingly necessary.