Amid today's choppy economic waters, boards, remuneration committees and activist shareholders need to revisit the approaches traditionally employed to define and assess the performance of their executives.

The conventional wisdom on target setting is that companies should set 'stretch, but realistic' targets. In essence, companies are trying to find a 'sweet spot' – one that represents a step increase above their historical performance trajectory, yet is also fair to the management. However, not many companies have been able to translate this philosophy successfully into practice.

Aon Hewitt believes that there is no silver bullet solution to target setting. nonetheless, boards and compensation committees can institutionalize a reasonably comprehensive target setting framework to set the 'bar' for the value that the management needs to create for its shareholders, and can assess whether their actual performance has met expectations in a transparent and objective way.

What Ails Conventional Target Setting Systems?

In our experience, most leading companies are able to articulate their performance metrics in a way that reasonably captures the firm's strategy and key drivers of value creation. As a case in point, Temasek (Singapore) has clearly articulated guidelines for their investee companies, requiring them to consider sophisticated issues such as risk adjustment for use of capital, as well as balancing long-term versus short-term orientation when making choices on performance metrics.

While the performance metrics often capture the thrust of the organization's strategy, the approach of setting targets and appraising performance using these metrics is much less robust. In reality, many companies do not have the facts they need to make fully informed decisions about target setting. Instead, they make do with an eclectic mix based on hard data (that is not broadly shared across the senior team or the board), and legacy opinions that have acquired the status of facts simply because no one has ever challenged them. As a result, assumptions are not tested, and more often than not, the board and the management resort to their 'comfort zone' of extrapolating last year's actual performance to set next year's targets.

These issues should be examined more closely because they illustrate the underlying components of the target setting process – politics, emotions and analysis.

Understanding the Emotional Component

The target setting process is often an intensely personal experience for the CEO and the board. The fact that a few million dollars of management compensation is linked to achievement of these targets strongly amplifies the intensity. The board and the management can potentially view this process as scoring 'points' against each other. Upon conclusion of a recent board meeting, wherein we were asked to observe proceedings, one of the nominee directors remarked, 'We stretched our CEO economic profit targets by 20% and created 50 million dollars of additional shareholder value.'

Aside from the financial component, the notion of debating targets is fraught with the collision of egos. Some CEOs worry that the moment their management team is asked to participate in target setting discussions with the board, that their own leadership status and credibility will be undermined. Conversely, board members may be

While the performance metrics often capture the thrust of the organization's strategy, the approach of setting targets and appraising performance using these metrics is much less robust.

Board members may be concerned that challenging management goals could send signals that might be misinterpreted as unsatisfactory performance.

concerned that challenging management targets could send signals that might be misinterpreted as unsatisfactory performance, or loss of confidence by the board.

Another important dynamic that affects the process is the risk of distortion. For most boards, strategy and target setting discussions are already complex enough. Firstly, they need to interpret relevant facts, relying on people who know more about the details than they do. Secondly, they need to ascertain if management might intentionally skew some of the facts. Most importantly, they need to apply their own experience and perspective to decide whether the recommendations are right. It is not surprising then that this multistage process can be affected by any distortions in judgment. Individuals often are unaware of their own biases. Further, in the absence of detailed information, they may not even be equipped to detect or neutralize any such management biases (Reference 1).

Understanding the Political Component

Because target setting involves so many stakeholders – the management, the board and shareholders – the process inherently carries tensions arising from the different interests of each party involved.

Consider, for example, a diversified manufacturer that had representation from a Private Equity (PE) firm on its board. Historically, the firm had set incentives based on Return on Assets (RoA) targets at the company and the business unit level. However, for the year in question, the nominee director forcefully argued that significantly higher Earnings Per Share (EPS) targets should replace RoA targets. It turned out that the PE firm was contemplating a strategic sale and, as such, the EPS metric was a more acceptable yardstick for valuation.

Even more critical is the dynamic operating between the board and the management. Most large companies have a dedicated strategy department that diligently develops a rolling long-term plan every year. Often, these plans hardly get off the ground. Many companies, at least in theory, expect a functional leader, such as a Chief Financial Officer, to play the role of a challenger to the strategy. But an 'insider' whose primary job is to critique the management can lose political capital quickly.

Understanding the Analytical Component

A less subtle but significant issue impacting target setting is the depth and breadth of the analysis that supports the dialogue. In addition to the business plan, information on analyst consensus estimates, peer performance and future guidance, and the growth expectations implied in current market multiples, can yield valuable insights. yet, these are often not considered for reasons that can be attributed to nothing but inertia. In certain cases, these insightful factors are dismissed as irrelevant, with statements such as 'We are overvalued by the stock market.'

Scenario and sensitivity testing of key value drivers is far easier to incorporate into the analysis. Such tools are useful to improve the quality of the strategy through a deeper exploration of the risks involved. Moreover, they can also help the board understand the range of performance outcomes, set realistic levels of stretch in targets, design appropriate pay performance schedules, and develop a formal, proactive mechanism to recalibrate targets if 'tail' events occur.

A large chain of hotels was embarking on a diversification strategy into property development and management. Core to this strategy was to redevelop specific hotels in advantageous locations into commercial and residential assets. The redevelopment would dilute short-term operating profits but would deliver long-term value. The strategy underpinning the business plan was sound. However, a value driver discussion revealed a critical assumption that the entire profit of the assets under question would be lost during the redevelopment period. Deeper analyses revealed that a fair proportion of the MICE revenue (meetings, incentives, conferences, and exhibitions) from corporate customers could be reclaimed by other hotels in the chain. Mere presentation of information and analyses helped the board retest a critical assumption and drive a constructive target setting discussion with the management.

Overcoming the Barriers to Sound Target Setting

To be sure, some companies and their boards do a good job of exercising sufficient diligence in the target setting process. Overall, though, to be effective, firms must recognize and address the core issues we articulated earlier. A few best practices and practical tips that can improve both the process and the outcomes of target setting are as follows:

1. Require In-depth Information and Analysis to Support Target Setting

Boards and remuneration committees must insist on greater depth and breadth of the information underpinning the target setting conversation. Four main sources of information (refer to Figure 2) should be required:

- Business plans/budgets

- Peer analyses

- Capital markets, expectations

- Sensitivity/scenarios analyses

Management should not view these information requirements as tools intended to uncover slack in bottom-up forecasts. On the contrary, we have seen the management effectively use this information (and in particular, the 'what does it take' analysis) to defend their targets.

2. Co-opt Shareholders in the Target Setting Process

In addition to strengthening their management discussions with a solid fact base, boards can prepare themselves by having a dialogue with key institutional shareholders. In fact, understanding and managing shareholder expectations is an increasingly important responsibility of the board for both goal setting and incentives. Many institutional shareholders consult pay for performance tests from proxy advisors in order to scrutinize goals and incentive plans. However, boards would be well served to have direct interactions with a few key shareholders well before the disclosure event. If conversations are conducted early in the process, it is likely to be more open-ended and conducive to the candid sharing of information. In contrast, delaying the conversation until 'after the fact' can lead to discussions that take a defensive tenor.

3. Establish 'Top-Down' Direction

The CEO of a large engineering group required his business unit heads to identify three of the top five percent of the company's maintenance assets for potential disposal every year. The divisions were allowed to retain assets in this category only if they could demonstrate a certain minimum increase in return on investment. In essence, the burden of proof on performance improvement fell to the business heads, rather than the other way around. The additional effect was the launch of an underperforming asset reduction initiative by all business units that led to Return on Capital Employed (ROCE) improvements beyond the minimum threshold.

In another example, the board of directors of a large property player mandated that at a minimum, the CEO's performance scorecard should always include at least two Key Performance Indicators (KPIs), wherein performance is assessed relative to peers or with external benchmarks. Furthermore, the weights of these KPIs should exceed 30%. The more obvious motive was to lighten the cumbersome budget-based targets on some KPIs. Other positive results identified were an enhanced focus on non-financial drivers of the business, along with more comprehensive coverage of peer group performance in the business planning and target setting discussions.

4. Frame the Conversation Around a Range of Outcomes Instead of a Point Estimate

As highlighted earlier, scenario modeling elevates the notion of 'stretch' target setting beyond a mere catchphrase. Such modeling helps quantify 'stretch' based on the likelihood

Establishing targets is a good starting

point, but companies also need a sound governance mechanism

to revisit them over time.

of achievement. Also, by understanding the range of performance outcomes, remuneration committees can help define the performance upside and downside risks and fine-tune the pay-performance curve.

no doubt, the rigor of scenario planning influences the quality of target setting and incentive design. However, in our experience, the issue is less analytical and more one of organizational mindset. Most leaders feel uncomfortable with the very notion of acknowledging the existence of significant risks, let alone discussing them with the board.

The chairman of a large industrial group has successfully deployed a process to help the management with confronting the unknown. Because he has seen that anxiety creates underreporting of real risks, he has established a process to identify scenarios that first involves asking the management to paint a picture of what he calls the 'darkest nightmare'. Secondly, the management is given a chance to 'peer into the darkness' together with the board, so they can define the risk quantitatively. The next step is a detailed plan to counter each nightmare, while acknowledging clearly that certain risks are inherent in the business and can only be mitigated, not eliminated. A few other organizations use more sophisticated checklists to detect any bias in building scenarios.

5. Define the Conditions Under Which the Targets will be Adjusted or Revisited

Establishing targets is a good starting point, but companies also need a sound governance mechanism to revisit them over time. Progressive companies define boundary conditions that will trigger a reexamination of the plan. These could include big, non-recurring events such as mergers, divestitures and large investment projects. Certain other companies also define thresholds around variables, such as oil and commodity prices or freight rates, within which the targets will apply. The targets would be retroactively adjusted upon movements beyond the threshold to ensure that the management is not unduly rewarded or penalized.

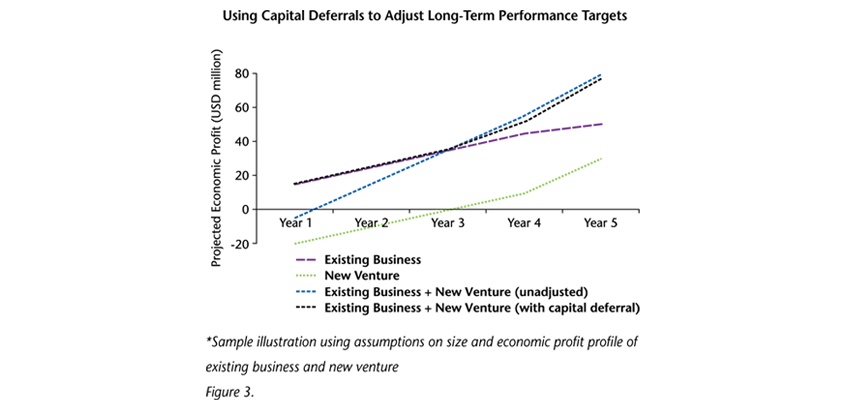

Many progressive companies not only articulate boundary conditions upfront, but also define the methodology for recalibrating targets. For example, quite a few asset-intensive companies have successfully deployed a capital deferral policy to incentivize managers to undertake strategic value creating investments that have long gestation periods. This involves creating a 'suspense account', wherein the planned negative earnings are 'parked' for a pre-approved gestation period. However, the management is held accountable for any overrun or additional deviation from planned earnings during the gestation period.

These adjustments not only eliminate the disincentive to invest in growth that creates long-term value, they also hold the management accountable for the additional capital they invest.

Reference:

- Refer to 'The Big Idea: Before You Make That Big Decision' by Daniel Kahneman, Dan Lovallo, and Olivier Sibony, Harvard Business Review, June 2011, for a more detailed and insightful exposé on cognitive bias in decision making.

This is an abridged version of the original article. The original is available on request.

|

|

|

|

|

Kumar Subramanian

Regional Practice Leader – Executive Compensation

& Performance, Aon Hewitt, India

For more information, please write to us at

[email protected] |

|

|

|