The economic uncertainty in the global markets, coupled with the crippling effects of delays in reforms, rising fiscal deficit and stubborn inflation has taken the sheen off the India growth story. The GDP growth in the last three months of 2012, has slowed to a shocking 4.5%; the eighth consecutive quarter of expansion below 8%. Amidst projections of a continuing bleak future, a big question on the mind of corporate India is the impact of the struggling economy on salary increases. The equation

on the surface seems simple – reduced growth, rising inflation and squeezing margins leading to a reduced pool for salary increases, but anyone will tell you that's not how it plays out or perhaps even how it should.

People-related expenses are viewed as an 'investment' and not simply as 'cost' and therefore, factors that drive these decisions go beyond short-term considerations.

Amidst a continued murmur of double-digit salary increases, despite a plethora of odds that perhaps make

The expectation or belief in the industry is that the economy will turn – being prepared for this situation means retaining top talent and people are willing to continue to pay top dollars to do that.

it seem very unlikely, we set out to understand what is really driving these salary increases and more importantly, to evaluate the often asked question – are these increases sustainable in an uncertain economic environment characterized by lower growth?

How do the Newcomers Stack Up Against the Veterans?

Let's rewind to 1991-92, where it all began. The decade that followed was euphoric. Our abysmally low salary levels and an acutely intense war for talent in an economy that was just opening up led to average salary increases as high as 20%. While towards the end of the decade that had settled to a relatively more palatable 15-17%, in some way it set the bar as far as employee salary increase expectations were concerned.

The decade of the 2000's was perhaps the most interesting or rather defining. The 2001-02 dot com crisis was at its worst, a bump on the road with the impact limited and quickly forgotten. While salary increases in the early part of the decade moderated to a 10-12%, the rapid growth period from 2004-07 took salary increases again to the 15% mark. In some way high growth allowed for more profligacy on the compensation spend.

The big pause came with the 2008 downturn. Compensation was right at the heart of the debacle and so began the scrutiny on pay levels, and more importantly, on its effectiveness. While the questions in India were not as scathing as the West, they were enough to shake us out of our comfort zone. The initial enthusiasm over a quick recovery still kept India at the top of the salary increase charts but the continued looming global depression and our own declining domestic situation nudged organizations to once again question the conventional wisdom.

While not advocating a reduction in salary increases, we do need to appreciate the changing dynamics of our economy and our workforce and reexamine the premise that we use to arrive at this number.

What Determines Salary Increase Budgets?

1. The Impact (or not) of Macro-economic Factors

A simple mathematical correlation of each year's GDP and inflation with salary increases since 1998 throw up abysmal numbers indicating almost no correlation. However, since salary increases are done at the beginning of the year (January to March) and GDP and inflation estimates are for the year ending, there is a lag in the decision making. The previous year's GDP and estimates through the year are more likely to impact the salary increase decision than the

year-end estimates. Similarly, the inflation rates prevalent during the period January to March would form a better consideration set. The correlation run in this manner does show some improvement (R2= 0.28) but is still not significant enough to be conclusive.

While major economic shifts like what we saw in 2001-02 and 2008-09 have a direct impact on salary increases, minor changes in either GDP or inflation don't influence salary decisions significantly.

Many would argue that these indicators are typically looked at post-facto and more than anything serve to create the justification for management decisions on salary.

One also needs to take into consideration what we could call the 'expected tipping point' wherein the expectation or belief in the industry is that the economy will turn, that policy reforms have to happen sooner rather than later, that our fundamentals continue to be strong, that interest rates will moderate, and FDI/FII will continue to happen – being prepared for this situation means retaining top talent and people are willing to continue to pay top dollars to do that.

2. The Macro Versus the Micro

One has always heard arguments against the so called 'average salary increase' number because the average is a fairly distorting statistic. A better way to look at influencers of pay increases would be to look at the micro picture. Arguably, the industry or sector performance is a closer

indicator of salary increases in that sector but we would go a step further to say that even within that we have seen paradoxes depending on individual entities. The financial health, the stage of evolution and the business strategy of each entity could explain the variance and the outliers. Many a time, organizations have overrelied on benchmarks while forgetting to contextualize rewards to their own situation.

The micro factors have a significantly higher influence on salary increases and therefore salary increases should always be looked at in context. Outside the context they may seem too prudent or too extravagant and can often lead to misleading debates and inferences.

3. The Talent Demand-Supply Mismatch

Talent shortage is touted as one of the key reasons for spiraling wages. While demographically India has an advantage over nations with an ageing population, the quality of the talent pool leaves a lot to be desired. Our Best Employer Study revealed that a large number of organizations found it difficult to fill vacant positions – particularly, at leadership levels. Organizations are therefore willing to pull out the big bucks to attract and retain the right talent.

Paradoxically, attrition rates however, continue to be high and contrary to its objectives, the high salary increases in a sellers market leads to rampant job hopping with the aim to increase one's salary.

The wage bill in an organization can get influenced by ensuring the right organization structure, optimum manning and appropriate talent mix.

The talent demand-supply mismatch is a reality, and while big pay packets may attract talent, they don't necessarily help organizations retain and engage them beyond a point. Our recent Total Rewards Survey shows that drivers for attraction, retention and engagement are very different and organizations need to go beyond cash to create a compelling employee value proposition.

4. Globalization and the Emergence of India as a Powerful Epicenter

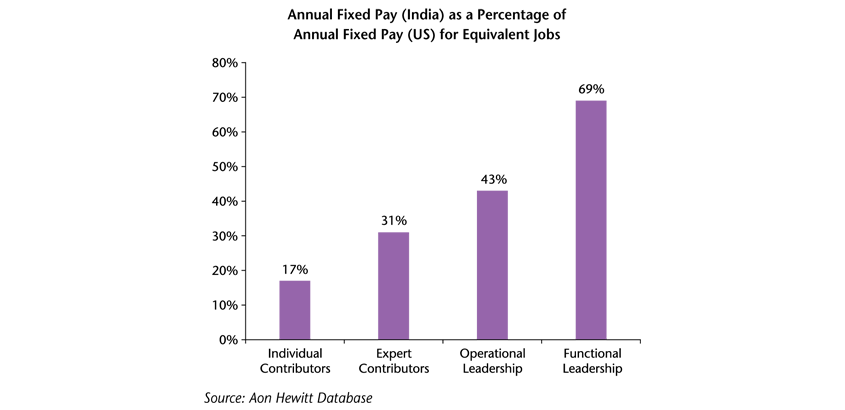

Rapid globalization and the opening up of the economy led to higher mobility and demand for the already coveted Indian talent. Both with MnC setting shop in India and exporting Indian talent to other countries, the existing low pay levels in India came to focus. We started playing the catch up game which very often justified the increases, even in the face of contradictory short-term macro or even micro economic indicators.

The data indicates a narrowing trend, particularly with top management salaries, which brings to the forefront the conundrum that organizations face now in balancing the need to compete for talent globally and capitalizing on the cost arbitrage that India offers.

none of the factors considered here are likely to change dramatically in the coming years. Economic fundamentals continue to be strong, most sectors are still attractive investment destinations and the talent flight between sectors and companies is likely to continue for some time. Salary increases in India therefore are not set out to tank in the near future. There will be periods like 2008, when economic pressure will lead to some correction but overall, organizations will continue to take a long-term view on talent.

The Question of Sustainability

Having looked at factors that influence salary increase budgets, we come to the next question of whether these increases are sustainable. While this question begs a definitive answer – the answer lies in perhaps two other more important questions:

- Can we continue to pay salary increases at current

rates but manage the wage bill?

- And how effectively are we deploying the salary

increase budget to ensure a return on the investment?

Managing the Wage Bill: The Productivity-Performance-Compensation Equation

To quote Mr. narayana Murthy from an interview with Aon Hewitt:

"As long as compensation as a percentage of revenue remains constant, it's (high salary increases yoy) not an issue. The focus needs to be on lead indicators like performance, growth and distinctive value creation, rather than the lag indicators, where we start to manage salaries to make up for margins and maintain cost arbitrage."

Similar thoughts were echoed by business leaders at a recent debate on sustainability of salary increases. They unanimously struck down the possibility of a reduction in the investment and instead spoke about focusing on innovation – in moving up the value chain, driving productivity and creating a compelling value proposition that goes beyond just salary increases. Pulling back on investment in rewards, they felt, may have long-term repercussions.

Organizations can continue to look at competitive salary increases while maintaining key metrices like compensation cost per employee or compensation as a percentage of revenue or profits through adequate productivity and performance gains. This will ensure that increases continue to remain sustainable in the long run.

Having said that, the problem we often face in India is an isolated salary increase decision taken solely on the basis of pay competitiveness. Take for example, an organization where the compensation per head appears too low in comparison to industry standards. The inclination typically is to increase pay scales. What that misses out on is that the organization may have deployed twice as much staff to handle the business as compared to its peers due to a lack of technology investment. It is critical therefore to get the full context on productivity and performance to take informed compensation decisions.

The wage bill in an organization can get influenced by ensuring the right organization structure, optimum manning and appropriate talent mix. Culturally, organizations in India have shied away from creating leaner structures to avoid the discomfort of layoffs. Contracting, outsourcing and shared services business models however, have emerged and contribute significantly to the ability of the organization to manage the wage bill.

Effectiveness of Rewards: What is Our RoI?

Much has been said and debated on the effectiveness of our rewards systems. High attrition, stagnant or falling engagement levels, weak linkages to the right performance metrics all point towards the belief that our rewards systems have failed in leveraging their full potential. An overreliance on cash has put innovation on the back burner. It is often said that difficult times drive innovation and force focus, and rewards management in India Inc. is seeing its share of a shakeout. Leading organizations are now dusting off their legacy and are willing to reset or rethink to get better RoI.

The direction of change can be classified into three broad categories:

Managing Total Rewards as a portfolio: Organizations are looking for more rigorous ways to determine if the spending on rewards is appropriately sized and appropriately allocated to specific areas like fixed pay, bonus, benefits, and work environment, to get the best results in retention and productivity.

Customized rewards: Organizations are moving towards more personalized and experiential rewards as they create a better emotional bond with the organization and are harder to replicate than transactional rewards. Understanding employee preferences and providing flexibility to cater to diverse aspirations is driving interest in segmented rewards offerings, flexibile benefits and a host of work-life and wellness-related initiatives.

Better alignment with performance: While most organizations in India espouse a pay for performance philosophy, an effective identification and measure of the right performance metrics leaves a lot to be desired. Companies often focus on internal measures of performance, but this has its limitations. Benchmarking performance and productivity can help reveal a clearer picture. By analyzing different financial metrics, understanding the strategy, the structure, and the drivers of performance and productivity, organizations can better appreciate why they performed better or worse. At the very least, this helps organizations make better-informed compensation decisions.

In Closing

After nearly two decades of double-digit salary increases we have evidently not managed to fulfill the objectives of retaining and engaging our talent and motivating them to deliver higher performance. We seem to be held hostage by competitive benchmarks and untested assumptions. While the deteriorating economic situation provides us with the opportunity or the canvas to redesign or relook at some of our compensation approaches, we must dig deeper and go beyond the salary increase number if we are to bring about real changes with real impact. Tweaking the number up or down will just be a reactionary short-term fix which will soon be forgotten and we will continue to live with the imperfections of our current systems till the economic cycle turns again.

|

|

|

|

|

Shilpa Khanna

Lead – Research & Insights,

Rewards Consulting, Aon Hewitt, India

For more information,

please write to us

at

totalrewards@aonhewitt.com |

|

|

|