Defined contribution (DC) pension schemes need to maintain momentum in considering sustainability risks and opportunities in their investment portfolios. “We cannot let perfection stand in the way of progress”, says Kath Patel, Aon’s head of DC Responsible Investing.

For sustainable investment funds, the last two years have been challenging. Increased political pressure, litigation against the integration of environmental, social and governance (ESG) factors in investment decisions, accusations of greenwashing and stellar performance from oil and gas companies (which are typically underweight or excluded from these funds) might not paint the rosiest of pictures.

On the other hand, the impacts from sustainability issues have become ever more real. 2023 was the warmest year on record globally. We know the knock-on effects this can have - flooding destroys property and infrastructure, damages supply chains, and disrupts business in affected areas. In the UK alone, the cost of flooding and coastal change damage is around £120 million per year. Excessive temperatures cause heat stroke and exacerbate existing health conditions such as diabetes, reducing productivity and undermining employee wellbeing. In India, a prolonged heatwave this year resulted in 40,000 cases of suspected heat stroke, and over 100 deaths. That is a terrible human cost, but it is also a business cost as well.

Investors might feel that they have a dilemma on their hands. Environmental and social risks have the potential to materially impact businesses and therefore future investment returns. But the current financial market environment appears to be making it difficult for some to be able to justify ‘going sustainable’ with their investment portfolio.

One thing overlooked in this argument is that sustainable investing is not just about managing downside risk – there is a huge investment opportunity as we start to transition to a more sustainable global economy. The historic agreement at COP28 to transition away from fossil fuels is a potentially significant turning point. And for DC schemes in particular, we have to continue to ask what the point is in helping members to save for retirement if the world they are retiring into is essentially unhabitable.

DC Schemes’ Progress is Slow but Steady

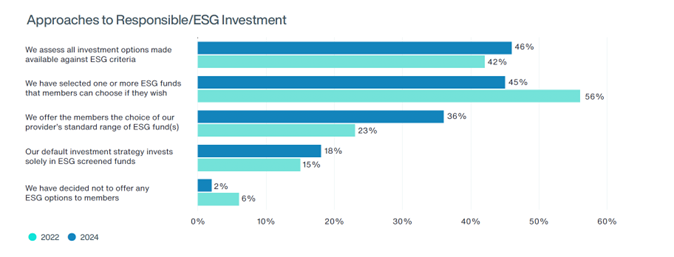

Aon’s 2024 DC Pension Scheme Survey, Five Steps to Better Workplace Pensions, asked 214 trustees, pensions managers and HR professionals about their responsible investment views and practices, as well as other aspects of DC pensions strategy.

The results show some progress since 2022 in terms of how many schemes have already embedded responsible investment into their default and self-select investment strategies. This is positive, but there are still a significant number of schemes yet to take action and to make a real difference, schemes which have already taken action need to find ways to go further – and faster.

At a minimum, all DC schemes are required to have a policy on how they account for financially material ESG factors (including but not limited to climate change) within their investment strategy. They must also publish an annual implementation statement setting out how such policies are being put into practice. Some DC schemes also have to make further climate-specific disclosures aligned with the recommendations of the Taskforce on Climate-related Financial Disclosures - something that is no small undertaking.

Given this increasingly intense focus from the Pensions Regulator, we were surprised to see little movement in the proportion of schemes investing their default solely in ESG screened funds, which moved from 15 percent in 2022 to only 18 percent in 2024. Additionally, the proportion of schemes assessing their investment options against ESG criteria has also stayed relatively static at 46 percent, only increasing by four percent and still accounting for less than half of all scheme respondents. On a more positive note, there are now only two percent of schemes that do not offer any ESG options to members at all.

Our findings suggest that responsible investing is not yet fully embedded in DC schemes’ decision-making.

But Why?

The previously mentioned fear of missing out on investment returns from portfolio companies that are typically ‘bad’ from a sustainability perspective and risks of being exposed to greenwashing are possible reasons. But it could also be that some DC schemes do not see any of the current investment solutions available as being good enough to invest in. It is no secret that our understanding of ESG is still developing and that many of the cost-effective solutions available to DC schemes rely on ESG data in order to build their portfolios. This data is far from perfect. However, waiting for perfect data and perfect understanding means that pension schemes may miss the boat not only on some of the sustainable investment opportunities coming to light, but also in helping to shape a more sustainable planet through their funds.

If the pensions industry is to (1) avoid the increasing long-term financial risks around sustainability issues, (2) be part of the sustainable transition and benefit from the investment opportunities that come with and (3) make a difference when it comes to environmental and social issues impacting their beneficiaries’ quality of life, more needs to happen and it needs to happen faster.

A Framework for Responsible Investment

Following a framework can help schemes to make better and faster decisions about responsible investing:

- Agree your principles: This could include discussing and agreeing collective views on screening investments, how to engage with fund managers, or increasing investments that have a positive impact on the environment or on society.

- Understand your current investments: While there is no perfect way to quantify ESG risks within investment portfolios, some insight and understanding is better than nothing. It is also worth noting that the UK government has announced plans to regulate and address the current lack of transparency behind ESG ratings from 2025, which could help schemes better assess their position and ultimately take action.

- Consider opportunities as well as risk mitigation: As we move to a more sustainable society, shifts in regulation, business practices and consumer demand mean that there will be many innovative investment opportunities for DC schemes and other long-term investors.

- Review and evolve your approach: We are still at the early stages of understanding the drivers of climate change, how to mitigate them and what that will mean in the future for investment practices. Being open to change and regularly reviewing your investment approach is essential.

DC pension scheme investment is a multi-decade undertaking. The long-term effects of climate change will be most keenly felt by employees who are now at the beginning of their working lives. Regulatory compliance can go part of the way to ensuring that DC schemes invest in the interests of members as part of their wider fiduciary duties, but to make a real difference, trustees, pensions managers and employers need to take time to explore their own principles and be open to evolving their responsible investment strategy over time.

Download Aon’s 2024 DC Pension Scheme Survey here.