Aon | Professional Services Practice

Do We Have a Deal? Law Firm Mergers in the Spotlight

Release Date: June 2024To merge or demerge? Sometimes the deal gets done, sometimes it’s all just talk. A dynamic law firm deal landscape has recently featured a big transatlantic merger and a notable decoupling of big firms.

In May 2023, London-based Allen & Overy and New York-based Shearman & Sterling announced their intention to merge, generating substantial attention in the legal and financial press.

Although big law firm mergers are not uncommon, they do not always last forever. A notable decoupling occurred in 2023 when Dentons fundamentally altered its partnership with Beijing-based Dacheng. This decision also highlights the changing Chinese professional service firm landscape, with increasing government scrutiny and strict data privacy rules giving firms pause.

The past year has also seen some notable examples of prospective mergers falling apart with the parties walking away from a potential deal.

Whenever firms explore the mergers and acquisitions (M&A) landscape, it is crucial to consider and understand the relevant risk trends and requisite and effective pre-transaction due diligence processes.

A Game-Changing Move

Partners at Magic Circle1 law firm Allen & Overy and U.S. law firm Shearman & Sterling voted in October 2023 to form a fully integrated global law firm, with the merger being completed in May 2024. Described by a Harvard Law professor as a “game-changing move,”2 A&O Shearman will have combined revenues of approximately USD $3.5 billion.3

Both parties had previously pursued negotiations with other potential merger candidates. Shearman & Sterling had been in discussions with Hogan Lovells, but the parties walked away from merger talks in March 2023. Allen & Overy also unsuccessfully pursued a partnership with Los Angeles-based O’Melveny & Myers in 2019.4

Allen & Overy, along with other leading UK law firms, saw opportunities in the lucrative U.S. market, driving the merger discussions.5 Other Magic Circle law firms, such as Clifford Chance and Freshfields Bruckhaus Deringer (Freshfields), have attempted to enter the U.S. market in the past.6 Freshfields has been keen to recruit experienced U.S. lawyers and has set up a tech-focused office in Silicon Valley.7

The A&O Shearman deal represents the first merger between a Magic Circle firm with a U.S. competitor since Clifford Chance merged with New York-based Rogers & Wells in 2000.8 The merging entities also intend a full integration, in contrast to past transatlantic mergers, where alternate corporate structures, such as a Verein, have been favored.

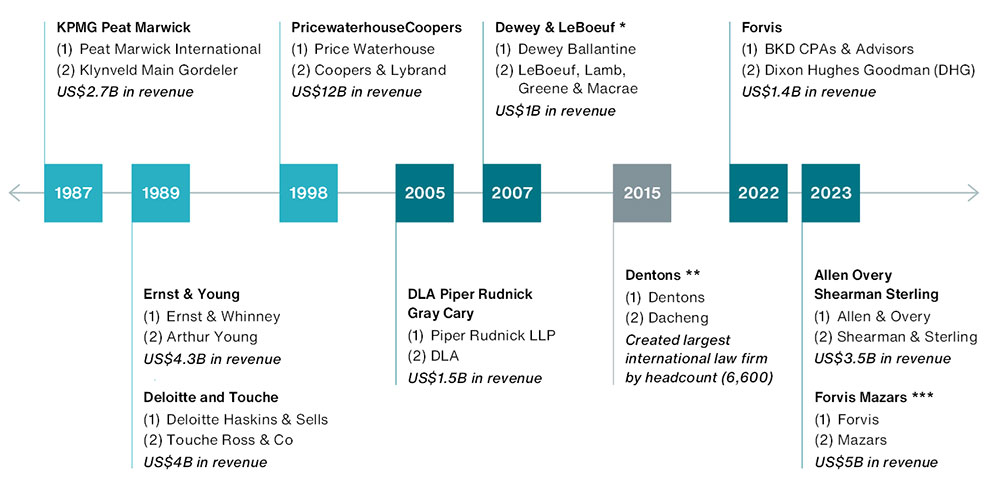

Timeline of Notable Mergers & Acquisitions | Professional Service Firms [1987-2023]

This document may not represent the most current information available.

* Filed for bankruptcy in 2012

** Partnership ended in 2023

*** Firms will operate as a global network

The China Challenge

Professional service firms are being scrutinized in China, particularly those with ties to the U.S. In February 2023, the Chinese government called upon companies to allow current mandates with the Big 4 to expire and appoint a replacement from the Chinese or Hong Kong audit sector. Law enforcement officials have conducted raids at the offices of major multinational consulting firms. This has contributed to U.S. law firms making the strategic decision to either scale back their operations or exit the mainland.

In September 2023, Los Angeles-based Latham & Watkins announced the closure of its Shanghai office as part of a strategic pivot to Beijing. In July 2023, another U.S. law firm, Ropes & Gray, decided to downsize its presence in Shanghai in favor of Hong Kong.9 In June 2023, New York-based Proskauer Rose decided to close its mainland China office.10

Restrictions on U.S.-China trade in advanced technology in such areas as quantum computing, AI and semiconductors has also given pause to some U.S. law firms. In October 2023, Silicon Valley stalwart Wilson Sonsini Goodrick & Rosati announced that it was exploring a move to Singapore as the number of U.S. companies pursuing tech deals in China has slowed.11

Perhaps the biggest law firm story emerging from China came in August 2023, when Dentons announced that it was “decoupling” from Beijing Dacheng Law Offices (Dacheng), undoing a partnership that had created the largest law firm in the world by headcount. Dentons expressed concern over the strictness of China’s information privacy regime12 as well as new requirements over “capital control and governance.”13

Months before the Dacheng announcement, staff had been advised not to travel to China and some were “delayed by many weeks” when attempting to leave the country. New “anti-spying” rules meant that it became nearly impossible to share information between Chinese and non-China based partners.14

Though the historic partnership has come to an end, Dacheng will continue to “operate as a separate and independent legal entity under a ‘preferred firm’ relationship with Dentons”.15

Failure to Launch

It is perhaps an understatement to note that merger discussions do not always bear fruit. According to a former managing partner of Clifford Chance, the failure of the A&O Shearman negotiations would have been “cataclysmic in terms of the credibility of the leadership,” both firms having recently engaged in public merger talks that did not lead to deals being made.16

Failures to launch can also contribute to more dire results for firms. For example, New York-based Stroock & Stroock & Lavan (Stroock), actively looked for merger partners, although issues like the firm’s sizeable pension obligations were creating potential obstacles. After one candidate, Pillsbury Winthrop Shaw Pittman, ended merger discussions with Stroock in October 2023, the firm was faced with partner defections and the need to cut salaries. Eventually, Stroock partners voted to dissolve the 147-year-old firm.17

While it can be argued that Stroock was hampered by slowing demand, declining revenues, and weakened by a series of partner defections, it is also clear that the failure to find a suitable merger candidate contributed to its demise.

Getting the timing right on a merger deal is also important. Philadelphia law firm Schnader Harrison Segal & Lewis (Schnader) was criticized for waiting too long to secure a merger. Schnader announced its dissolution in August 2023, following failed talks that only started in May or June of the same year.18

A failure to launch can cause turbulence, even if it doesn’t mean the end of the law firm. Following the end of merger discussions with Hogan Lovells in March 2023, Shearman decided to make a leadership change and replaced its managing partner,19 eventually leading to the blockbuster Allen & Overy deal.20

Buyers’ Market Drives Demand for Enhanced Due Diligence

M&A and other market transactions are complex, time-critical, and highly specialized. M&A and finance professionals need partners who understand their goals and challenges and bring robust knowledge of the transaction processes. Aon’s M&A team has experienced an increased demand for enhanced due diligence services over recent years. Of relevance to professional service firms:

- People Transaction Advisory

- Cyber Diligence

- Risk and Insurance Diligence

- Representations & Warranties Risk

- Tax Risk

- Litigation Risk

- Intellectual Property Solutions

The Professional Services Practice at Aon and the Aon M&A and Transaction Solutions (AMATS) team will continue to monitor developments related to M&A and due diligence, particularly with relation to professional service firms, and related matters.

2 “Allen & Overy closes in on American dream with $3.4 billion Shearman deal,” Financial Times, May 23, 2023.

3 “Allen & Overy, Shearman partners approve law firm mega-merger,” Reuters, October 13, 2023.

4 “Shearman & Sterling and Hogan Lovells abandon merger talks,” Financial Times, March 3, 2023.

5 “Profits stall at London’s ‘magic circle’ law firms during pivotal expansion,” Financial Times, July 31, 2023.

6 “Allen & Overy, Shearman Merger Approved by Firms’ Partners (2),” Bloomberg Law, October 13, 2023.

7 “Profits stall at London’s ‘magic circle’ law firms during pivotal expansion,” Financial Times, July 31, 2023.

8 “Law firm management: planned A&O and Shearman deal among largest sector has seen,” International Bar Association, July 20, 2023.

9 “The China Dilemma: Should Law Firms Call It Quits?” Law.com, September 25, 2023.

10 “Global law firm Dentons’ retreat exposes China risks,” Financial Times, August 10, 2023.

11 “Law firm Wilson Sonsini explores Singapore office as China dealmaking slows,” October 14, 2023.

12 “The China Dilemma: Should Law Firms Call It Quits?” Law.com, September 25, 2023.

13 “Global law firm Dentons’ retreat exposes China risks,” Financial Times, August 10, 2023.

14 “Global law firm Dentons’ retreat exposes China risks,” Financial Times, August 10, 2023.

15 “Dentons Ends Dacheng Combination in China,” Law.com, August 7, 2023.

16 “Allen & Overy, Shearman Merger Approved by Firms’ Partners (2),” Bloomberg Law, October 13, 2023.

17 “Demise of 147-year-old Stroock is boon for law firm rivals,” Reuters, November 13, 2023.

18 “Ailing Firms Value Independence, Autonomy Over Survival, Delaying Vital Merger Talks,” Law.com, August 18, 2023.

19 “Law firm Shearman & Sterling names new leader after merger talks fail,” Reuters, March 7, 2023.

20 “‘A Terrible Situation’ or ‘Still Well Established’: Where Do the Failed Merger Talks Leave Shearman?” Law.com, March 3, 2023.

Contact

The Professional Services Practice and the Aon M&A and Transaction Solutions (AMATS) team will continue to monitor developments related to M&A and due diligence, particularly with relation to professional service firms, and related matters.

If you would like to discuss any of the issues raised in this article, please contact Daniel Hacikyaner, Jennifer Millar or Jens Peters.

Daniel Hacikyaner

Vice President and Director

Montreal

Jennifer Millar

Managing Director

London

Jens Peters

Account Executive Manager

Montreal

About Aon

Aon plc (NYSE: AON) (NYSE: AON) exists to shape decisions for the better — to protect and enrich the lives of people around the world. Through actionable analytic insight, globally integrated Risk Capital and Human Capital expertise, and locally relevant solutions, our colleagues in over 120 countries and sovereignties provide our clients with the clarity and confidence to make better risk and people decisions that help protect and grow their businesses.

Follow Aon on LinkedIn, X, Facebook and Instagram. Stay up-to-date by visiting Aon’s newsroom and sign up for news alerts here.

©2024 Aon plc. All rights reserved.

Aon is not a law firm or accounting firm and does not provide legal, financial or tax advice. Any commentary provided is based solely on Aon’s experience as insurance practitioners. We recommend that you consult with your own legal, financial and/or insurance advisors on any commentary provided herein. All descriptions, summaries or highlights of coverage described herein are for general informational purposes only and do not amend, alter or modify the actual terms and conditions of any relevant policy. Coverage is governed only by the terms and conditions of such policy. Insurance coverage in any particular case will depend upon the type of policy in effect, the terms, conditions and exclusions in any such policy, and the facts of each unique situation. No representation is made that any specific insurance coverage would apply in the circumstances outlined herein. Please refer to the individual policy forms for specific coverage details.

The information contained in this document and the statements expressed are of a general nature and are not intended to address the circumstances of any particular individual or entity.

This document is not intended to address any specific situation or to provide legal, regulatory, financial, or other advice. While care has been taken in the production of this document, Aon does not warrant, represent or guarantee the accuracy, adequacy, completeness or fitness for any purpose of the document or any part of it and can accept no liability for any loss incurred in any way by any person who may rely on it. Any recipient shall be responsible for the use to which it puts this document. This document has been compiled using information available to us up to its date of publication and is subject to any qualifications made in the document.

Insurance products and services offered by Aon Risk Insurance Services West, Inc., Aon Risk Services Central, Inc., Aon Risk Services Northeast, Inc., Aon Risk Services Southwest, Inc., and Aon Risk Services, Inc. of Florida and their licensed affiliates.