Aon: Asia Pacific Companies See ESG Issues of Critical Importance; However, More Work Is Needed To Fully Integrate Measures

- 58 percent of companies surveyed say ESG is critical to the long-term success of their business

- Only 29 percent of companies surveyed include ESG-related goals and key performance indicators for their C-suite

- 34 percent of companies surveyed have a dedicated ESG function

SINGAPORE (18 April 2023) – Aon plc (NYSE: AON), a leading global professional services firm, today released its 2023 Asia Pacific Corporate Governance and ESG Survey Results which found that while the surveyed companies indicate environmental, social and governance (ESG) issues are critical to their organisations, most are lagging in integrating ESG measures – either via aligning to goals and key performance indicators (KPIs) or allocating a dedicated function to monitor ESG issues.

Despite 58 percent of surveyed companies stating ESG is critical to their long-term success, only 29 percent include ESG-related goals and KPIs for their C-suite, with most companies in Asia Pacific still in the early stages of using ESG metrics and developing their ESG profile.

While only 34 percent of companies reported having a dedicated ESG function, business strategy – instead of compliance requirements - is the primary driver of action on ESG in Asia Pacific, as the regulatory environment is still evolving in most of the surveyed countries.

Linking ESG to financial incentives is needed

Accelerating and expanding ESG efforts requires boards and management in the region to better understand the link between ESG and business strategies and use metrics and performance measures as their ESG maturity improves.

“Incorporating ESG performance criteria into executive compensation plans means ESG metrics are more likely to align with the company’s overall strategy and compensation plans. It is becoming clear that failing to address and integrate ESG metrics in the future will expose companies to reputational risk, financial impacts and regulatory consequences as they navigate new forms of volatility,” said report author Boon Chong Na, advisory partner and corporate governance and ESG lead, Human Capital Solutions for Asia Pacific at Aon. “However, while improving ESG metrics, companies need to manage both the financial and non-financial aspects, as shareholders expect them to do well while also doing the right thing.”

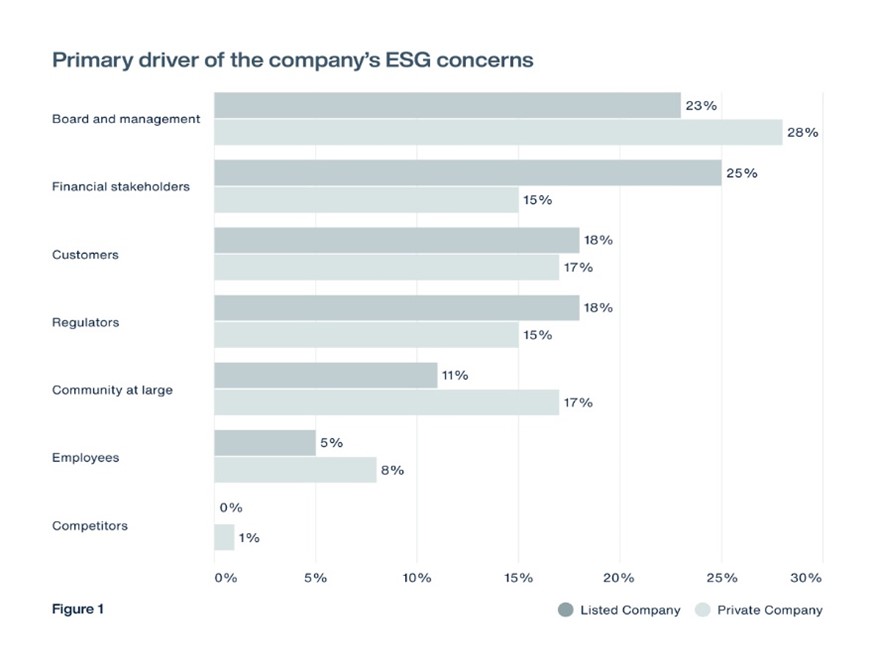

Compared with privately held companies, listed companies are twice as likely (48 percent) to have clearly defined ESG metrics and to link them to C-suite performance.

Partner and Head of People Solutions for Australia at Aon, Simon Kennedy, said while difficult to make the transition to linking metrics depending on where listed or private companies are in the process of their ESG journey and with some markets ahead of others in the region, it is no longer enough to commit to targets that are not tied to either a financial incentive or disincentive.

“The first step is to align ESG targets with business strategies and goals. Companies can retain their existing measures, no matter how simple, and enhance them as they move forward. Ideally, ESG targets need to be as measurable as financial targets, preferably using audited numbers based on established standards,” said Kennedy.

Board education also key to integrating ESG

While 61 percent of respondents reported that they involve their entire board in decisions concerning ESG, 41 percent do not have a formal process or training program in place to educate board members about contemporary ESG topics.

“Among survey participants, most companies currently conduct only one or two education sessions on ESG per year for their boards. Whilst directors are expected to be deeply involved in developing and overseeing ESG strategy, training is required to ensure board members are adequately informed and capable of making sound judgements about the ESG risks and opportunities under their governance,” said Kennedy.

Green talent becoming a priority

Another key factor that emerged in the report is the issue of green talent, as nearly one-third of surveyed companies plan to introduce or expand ESG roles, with 76 percent of positions being hired at the mid-professional level.

“Companies will need to embark on job redesign and upskilling initiatives and invest in their talent to meet this growing demand, either through external university programs, micro-credentials, sustainability certifications or internally managed employee training. A comprehensive talent strategy is essential to keep businesses competitive, and a robust workforce reskilling program can help build a more resilient workforce, enhancing the potential of existing employees even if external talent pools are shrinking,” said Na.

Further key findings from the report include:

- 25 percent of private companies and 50 percent of listed companies have a dedicated ESG team.

- 30 per cent of new initiatives in 2023 involve re-skilling or upskilling the workforce on ESG.

- 61 percent of boards are actively monitoring diversity, equity and inclusion (DE&I).

About the survey

Aon conducted the ESG survey of senior leaders of both private and publicly listed companies across all industry sectors between October and December 2022. More than 255 companies participated from Australia, India, Singapore, Japan, Malaysia, and China. Read the APAC ESG report

here.

About Aon

Aon plc (NYSE:AON) exists to shape decisions for the better — to protect and enrich the lives of people around the world. Our colleagues provide our clients in over 120 countries and sovereignties with advice and solutions that give them the clarity and confidence to make better decisions to protect and grow their business.

Sign up for News Alerts

here