Four Ways to Manage Rising Medical Benefit Costs in 2024

Amid ongoing inflation and economic volatility, organisations in Asia Pacific are grappling with an expected sharp spike in employee medical plan costs for 2024.

Key Takeaways

- According to our 2024 Global Medical Trend Rates Report, the average cost of employer-sponsored medical plans has more than doubled over the past 10 years, with the medical trend rate for 2024 now expected to reach 9.7 percent in Asia Pacific, up from 9.2 percent in 2023 – and the highest it has been since 2015.

- Health and wellbeing costs are a concern as year-over-year medical plan costs continue to rise. This could bring unexpected or unbudgeted cost increases and make affordability more difficult for employers and employees. As our latest APAC Employee Benefit Trends Report reveals, employers now consider the rising cost of medical benefit plans to be among their top five challenges.

- Value-based plan designs, including flexible benefit plans, give employers more cost control while enabling employee behaviour change. According to our 2024 Global Medical Trend Rates Report, value-based plan designs will be a top mitigation initiative for 2024.

Medical Plan Cost Drivers in 2024

Reasons for rising costs in Asia Pacific include:

- Employees have been using their benefits more since COVID-19 controls were lifted.

- Medical inflation has increased due to the rising cost of medical supplies and medication, and labour shortages in some markets.

- Many organisations enhanced their employee benefits offering during the pandemic, while utilisation was low.

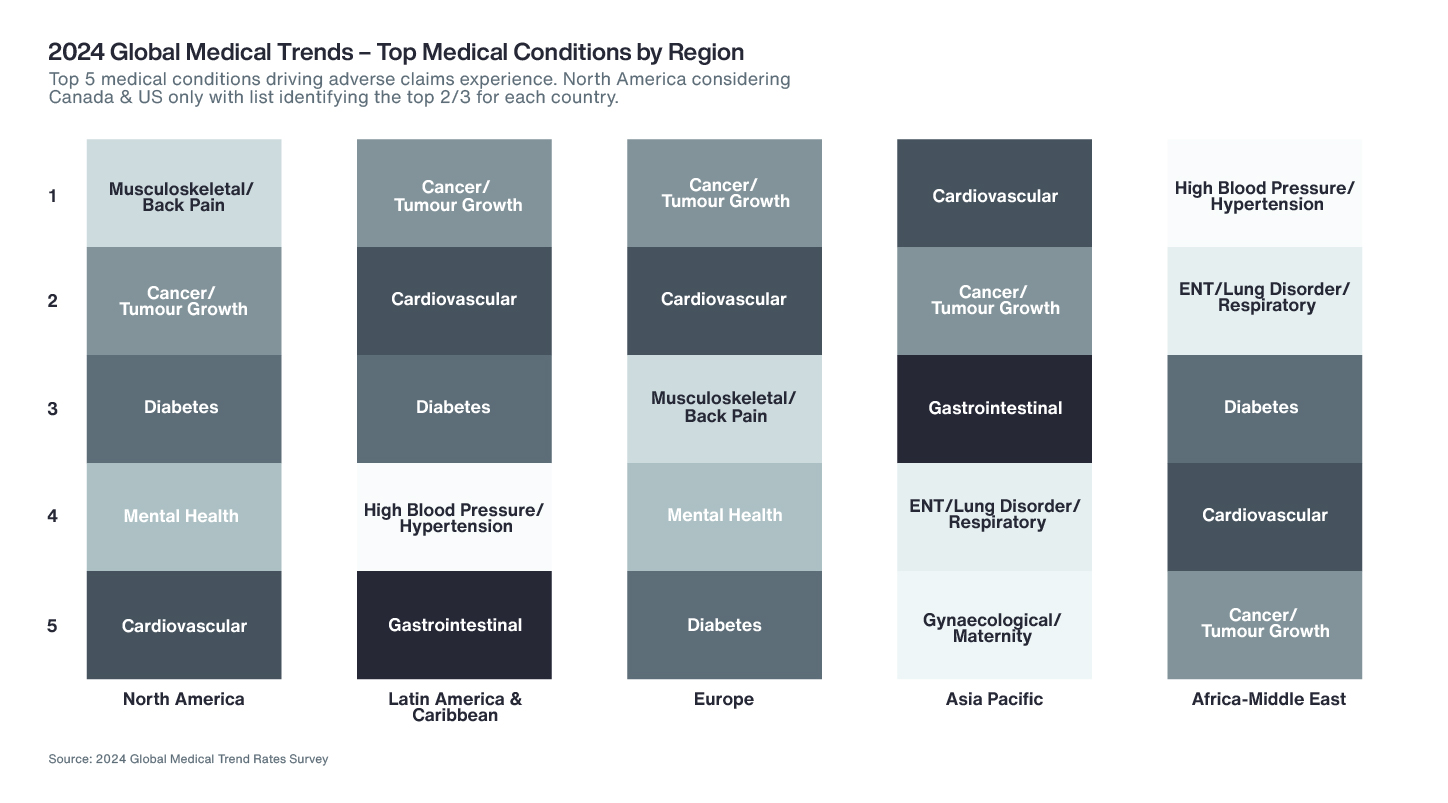

According to the report, the top medical conditions driving medical plan costs in 2024 throughout Asia Pacific are:

- Cardiovascular

This condition was almost absent during the COVID-19 pandemic as social distancing resulted in fewer cases of cold and flu. - Cancer/Tumour Growth

Traditionally a high contributor to claims in North Asia, cancer rates are now higher than normal, possibly due to delayed diagnoses during the pandemic. - Gastrointestinal and Digestive Issues

These conditions continue to be a leading contributor to claims, especially in South Asia.

Breaking the Cycle of Rising Costs

Our annual Global Medical Trend Rates Reports estimate costs in advance so employers can address projected price inflation and plan usage patterns. Whilst cost optimisation should always be balanced with the impact on employee experience, we are now seeing more examination of plan design reductions or employee cost sharing and more difficult decisions than at any other time in the past 10 years.

“Improving return on benefits investment involves controlling costs, which we can achieve by decreasing the average value and frequency of claims, or by improving the health and wellbeing of the workforce. This can deliver several advantages, from higher levels of employee engagement and productivity to fewer absences.”

Marina Sukhikh, Director of Analytics, APAC Health Solutions, Aon

Four Common Cost Containment Strategies

The focus for many in this environment is necessarily on the short term but it is important not to lose sight of investment in longer-term strategies that will pay dividends as the medical trend environment normalises. The current focus is also more on cost-based strategies that unfortunately have most impact on employees but for some organisations are a necessary step to achieve financial constraints.

Here are four common cost containment strategies adopted by employers in APAC.

| Time Frame Value Focus

|

Cost Based | Risk Based |

| Short-term | Cost Sharing Expected to play an important role in achieving budget expectations in 2024, cost sharing strategies are aimed at reducing or controlling overuse, such as raising deductibles and co-pays, referrals and plan restrictions. Whilst effective, they have a significant impact on employee experience, controlling access to benefits and requiring workers to seek care in a more cost-effective manner. |

Risk Sharing This focuses on the commercial relationship between the sponsoring organisation and the insurer and hence minimises the impact on employees. At the extreme this may include self-insuring or self-administering benefits including leverage of a captive insurer. The reason this may be attractive is that part of the increase in costs is due to additional prudence for volatility being used by insurers in their pricing. If the sponsoring organisation can bear that volatility, then considering self-insurance of some form of shared insurance (e.g., profit share) maybe economically beneficial. |

| Long Term | Value-Based Design The most innovative and promising of the four strategies is value-based plans, including flexible benefits design, which provides employees with the power to customise the benefits they need while forgoing those they do not. Employees generally have a short-term bias so value the ability to customise more than the core benefits they give up in return. In this respect value-based plans can provide employers with a win-win more cost control while enabling behaviour change among employees. |

Wellbeing Initiatives Wellbeing programs help to control costs by encouraging utilisation of preventative care to avoid higher costs in the future. By keeping employees engaged in their wellbeing, they can also reduce the stress that can exacerbate other health conditions. Aon’s 2022-2023 Global Wellbeing Survey revealed that 49% of employers have increased their investment in wellbeing initiatives since 2020 and that the effectiveness of these initiates has doubled. It continues to be a boardroom topic for many organisations. |

Here are some examples of these strategies in action.

Case Study 1: Value-based Plan Design in China

Without the right data and insights, designing a programme based on the value of benefits can be challenging. So, when Aon was invited to help a large professional services firm in China, we began by analysing benefits utilisation and company data from several dimensions to:

- Understand how much choice employees had about medical treatments, and

- Explore employees’ financial capacity to absorb risks.

The client had effectively been offering unrestricted medical coverage and, as premium costs rapidly rose to unsustainable levels, leaders began to recognise the need for a new approach that would carefully balance costs while mitigating the risk of negative, unintended consequences, such as employee attrition.

The client’s data revealed that the perceived value of benefits was comparatively low when used for minor illnesses such as the flu, because most employees could visit a general practitioner (GP) and pay for treatment themselves. In contrast, employees had little discretion and limited ability to pay for emergency surgery should the need arise, so the perceived value of this benefit was higher.

After helping the firm identify its core priorities, assess claims data and model potential financial and workforce impacts of benefit modifications, the desired outcome was achieved. By implementing cost sharing, network management measures and benefits optimisation based on perceived value, our team helped the client reduce their costs by approximately 20%.

Case Study 2: Flexible Benefits in India

Flexible benefits have traditionally been more of an employee engagement vehicle than an effective cost-containment strategy. However, when they are designed well, flexible benefits can help companies halt rising costs. A large multinational organisation in India had a flexible shared-risk programme in place with voluntary benefits. However, participation was in decline and the programme faced financing risks, which were being compounded by high medical inflation.

“Our consultants boosted participation rates by encouraging the client to offer a broader range of optional medical benefits, more benefits to support diversity and inclusion, leave encashment, and wellbeing initiatives”, says Alan Oates, Aon’s Regional Head of Advisory and Specialty, Health Solutions. “These options boosted participation in the benefits programme and the sponsoring employer could more directly control investment through the cost of the flexible spending credits.”

Case Study 3: Shifting From an International to a Local Plan in Singapore

When medical inflation rose following the COVID-19 pandemic, employers found it difficult to continue offering benefits at the same level they had before. A large multi-industry organisation in Singapore had been offering a comprehensive international plan, but premium costs were increasing due to rising medical inflation, suboptimal claims utilisation and headcount growth.

“Through data analytics, our team identified key cost drivers, utilisation behaviours and employee needs, which helped them design a framework that included core and flexible benefits and a wellbeing strategy, all under a local plan”, says Todd Dore, Aon’s Regional Director of Analytics, Health Solutions. “Careful change management and clear communication ensured internal and external stakeholders’ expectations were managed effectively, without any detrimental effect to attraction and retention of talent”, he adds.

Watch the webinar for more medical benefit cost management strategies or talk to our team.