Podcast 23 mins

Better Being Series: Understanding Burnout in the Workplace

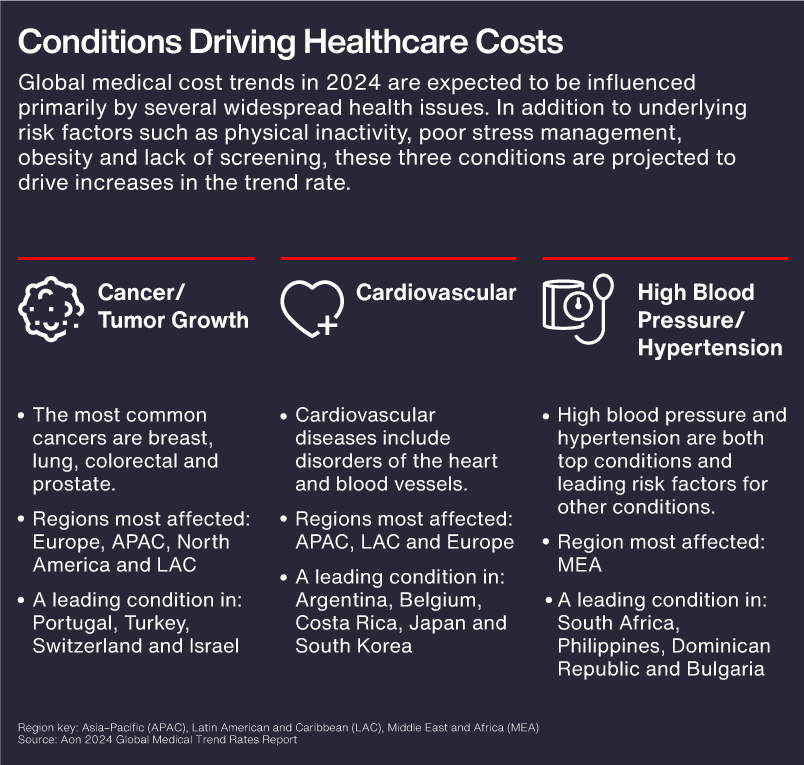

Employer medical plan costs are higher than they’ve ever been and are increasing at rates that have not been seen in nearly a decade. In 2023, costs were projected to increase by 9.2 percent globally on average, and cost increases are expected to climb to 10.1 percent in 2024. These increases are largely due to the current inflationary environment and partially due to economic instability around the globe. But the continued prevalence of certain conditions — namely cancer, cardiovascular disease and high blood pressure — have also propelled costs higher.

These trends illuminate a continued need for employers to make better-informed decisions about their health plans. The right data can help employers identify where they are spending the most money and where they should invest for the benefit of their workforce.

For global companies, health plan data can be a powerful tool to tailor offerings based on common conditions or needs in a region. Aon’s 2024 Global Medical Trend Rates Report discusses the main factors influencing employer medical plan costs and the regional differences in health trends. By taking a closer look at this data, employers can improve their health plans and identify and respond to cost pressures.

It’s fair to assume that complex macroeconomic conditions will continue for the next several years. Costs in healthcare are rising because of general inflation. However, according to Aon’s recent Global Medical Trend Rates Report, a confluence of consumer trends and an uptick in complex conditions, including lung cancer, diabetes and hypertension, have also contributed to higher costs, putting more pressure on employers to reevaluate their health plans.

“In the face of continued cost increases, employers are looking to adapt their medical benefits programs, what they cover and how they support employees,” says Kathryn Davis, vice president, data & analytics leader for Global Benefits at Aon.

So they can make better decisions on their healthcare plans, employers must understand the factors that are causing costs to rise, the health trends affecting their employees most and the data-driven solutions that can help them reimagine their benefits programs.

Three trends have had the greatest influence on costs for employer healthcare plans.

Though general inflation is one of the main drivers of increased healthcare costs, costs are also rising due to increased use of health services.

“During the height of the COVID-19 pandemic, people forewent elective treatments and were postponing care, resulting in lower incidence of claims,” says Davis. “As utilization rebounds, costs for smaller treatments like exams and therapies will also increase.”

Davis adds that as healthcare systems recover from the past few years, more resources are available to support non-COVID-19 conditions. As more people receive health screenings, more conditions are caught, which in turn raises the demand for additional healthcare services. Consequently, more people are using medical services , increasing claims and health plan costs for employers.

In addition to covering physical conditions in health plans, the rise in mental health conditions around the world has become an increasingly important issue for employers to address. “Since the beginning of the COVID-19 pandemic, the incidence of mental health conditions has been on the rise, and mental health conditions are increasingly becoming something that employees are seeking treatment for and missing work because of,” says Davis.

In fact, according to Aon’s 2024 Global Medical Trend Rates Report, mental health conditions were listed as the leading conditions driving claims in Europe. In Canada, these are the second most prevalent conditions, following diabetes. Part of the reason for this increase, Davis explains, is the macroconditions that are perpetuating stress, anxiety and depression. Awareness and acceptance of mental health conditions is much more widespread today and continues to expand, and workplaces are expected to weave these realities into their benefits coverage. The talent market has also inspired employers to invest in more-comprehensive benefits programs.

In fact, according to Aon’s 2024 Global Medical Trend Rates Report, mental health conditions were listed as the leading conditions driving claims in Europe. In Canada, these are the second most prevalent conditions, following diabetes. Part of the reason for this increase, Davis explains, is the macroconditions that are perpetuating stress, anxiety and depression. Awareness and acceptance of mental health conditions is much more widespread today and continues to expand, and workplaces are expected to weave these realities into their benefits coverage. The talent market has also inspired employers to invest in more-comprehensive benefits programs.

As part of those efforts, companies have moved from only providing medical coverage for major health-related events — a broken leg or giving birth, for example — to providing programs such as employee assistance programs (EAPs) that support employees’ broader health and wellbeing (and include mental health services). Medical coverage and EAPs work hand-in-hand, helping employees to acknowledge they’re having mental health struggles and then teaching them how to most effectively use their medical plan(s) to support those struggles.

Data from this year’s Global Medical Trend Rates Report suggests that many of the most prevalent health conditions and risk factors in 2024 are expected to be the same as those in 2023 — and these are also the main drivers of medical plan costs.

The 2024 Global Medical Trend Rates Report shows that cancer and cardiovascular health conditions have become more prevalent across the globe, ranking first and second in most regions and as top five conditions in every region.

Contributing to poor cardiovascular health, physical inactivity and poor stress management are two of the top health risk factors globally, and both can lead to more-serious health conditions if they’re not addressed. According to the report, physical inactivity is one of the top five health risks in every region across the globe; underlying factors might include lingering effects from stay-at-home orders during the COVID-19 pandemic or a lack of movement related to working from home . Additionally, poor stress management has become more of an issue in North America, the Asia–Pacific region (APAC) and Europe.

Risk factors can compound and lead to more serious conditions. For example, physical inactivity can lead to obesity, high blood pressure and/or high cholesterol, which could then lead to cardiovascular disease or risk of stroke. Poor stress management can impact mental health and lead to declining productivity and burnout. By addressing these risk factors in their health plans early, employers can help their workforce stay healthy and avoid more costly treatments for serious conditions.

Employers can use health data to educate their employees, build preventive programs and drive down costs. They can look at data to determine the top five to ten claims among their workforce and expand wellbeing programs or educate employees about existing programs to try to mitigate these claims wherever possible. Other steps employers could take include encouraging preventative behaviors or designing measures to incentivize plan members to seek care in a cost-effective way.

“Global companies can look at claims data within and across countries to identify outliers and cost drivers,” explains Davis. “Say you notice a much higher claims incidence in Argentina for lung cancer as compared to other employee populations. An employer could then look to implement a smoking cessation program in Argentina specifically to help mitigate that condition or stop conditions before they occur.”

Employers can also look at data to see how the health plans are being used and who they cover and then adjust use of the plans by clarifying or adapting who is covered by certain health benefits. On one hand, this measure could benefit employers by limiting coverage (e.g., to employees only) to minimize claims and costs. On the other hand, it could benefit employees where coverage is extended based on cultural trends. In the APAC region, Davis explains, data show that an increased acceptance of LGBTQ+ relationships has led to an emergence of same-sex partner coverage under medical plans in some countries. This extended coverage has undoubtedly increased the number of claims within the employer-paid healthcare plans, but it has also served as a step toward a more inclusive workplace and healthier workforce.

Opting for flexible benefits programs offers a solution for both employers and employees. With a “full flex” approach, employers can allocate employees a chosen amount of money to use toward their benefits as they see fit across a broad range of benefits. “A key premise behind flexible benefits is allowing employees to select the benefits they need and want to support their lifestyle,” says Davis.

An employee could use their flexible allotment toward a gym membership, a green car or even pet medical expenses aid, for example, without having to pay out of pocket. This approach could help protect employers because it gives employees agency over their benefits and helps change employee behavior in relation to the benefits package. It also helps put a cap on the cost of medical coverage because it disperses ownership over the plan between employees and the company, which helps guarantee good investments.

“Companies only see what employees show on the surface; employees know themselves better,” says Davis. “By enabling and empowering them to have choice, they can select the benefits they need and will use.”

General Disclaimer

The information contained herein and the statements expressed are of a general nature and are not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

Terms of Use

The contents herein may not be reproduced, reused, reprinted or redistributed without the expressed written consent of Aon, unless otherwise authorized by Aon. To use information contained herein, please write to our team.

Our Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

The construction industry is under pressure from interconnected risks and notable macroeconomic developments. Learn how your organization can benefit from construction insurance and risk management.

Stay in the loop on today's most pressing cyber security matters.

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Explore Aon's latest environmental social and governance (ESG) insights.

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Explore our hand-picked insights for human resources professionals.

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Our Pay Transparency and Equity collection gives you access to the latest insights from Aon's human capital team on topics ranging from pay equity to diversity, equity and inclusion. Contact us to learn how we can help your organization address these issues.

Forecasters are predicting an extremely active 2024 Atlantic hurricane season. Take measures to build resilience to mitigate risk for hurricane-prone properties.

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

Article 8 mins

U.S. freight and commuter rail industries are facing excess liability and property issues for different reasons. These railroads are critical to infrastructure and vital to the economy, yet finding effective solutions remains complex.

Article 11 mins

As private companies prepare for an IPO, they face increased risks that require directors and key leaders to adopt essential risk management strategies to ensure a smooth transition.

Article 10 mins

As climate change intensifies the frequency and severity of extreme weather events, public entities and businesses need more flexible funding solutions. Parametric stands out as an adaptable resource capable of swiftly responding to potential disasters.