Collection

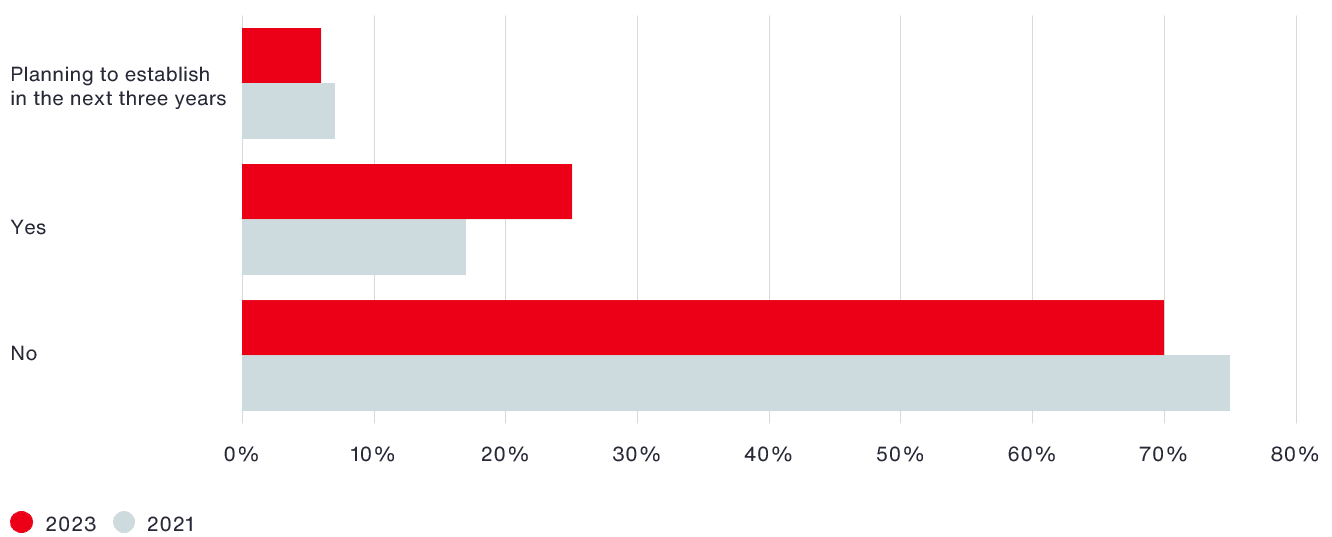

The use of captives has increased significantly in the past few years. Existing captive owners continue to utilize their captives much more to attain the coverage they need within budget, and many organizations are setting up new captives. Indeed, 25 percent of respondents to our 2023 Global Risk Management Survey indicated that they currently use a captive (up from 17 percent in 2021), and another 6 percent plan to establish one in the next three years. At Aon, we’ve seen a 43 percent rise in premiums written by captives under our management in the same period — the most pronounced growth to date.

The overarching impetus driving increased use of captives has been the challenging primary insurance market. Since 2020, insurers have been focused on recalibrating their business models to help ensure profitability and long-term viability. As a result, insurers have been much more selective about the types of risks they want to insure. Rates and deductibles have risen sharply across many lines, conditions have changed, and restrictions on existing coverage has tightened or been withdrawn. This environment has prompted many companies to turn to options outside of the traditional insurance market — such as captives — to protect their balance sheets.

One side effect of the movement toward alternative risk financing options and retaining more risk to keep costs stable has been improved risk maturity among many organizations and risk managers. Many companies, compelled by a growing need to understand the full extent of their exposures to ensure they can absorb the increased level of risk they may have taken on, have gained experience in how higher premiums, deductibles and retentions affect their balance sheets. And with the explosive growth in data and enhancements in analytic tools, companies now have greater confidence in their risk profiles. Consequently, many are more comfortable retaining more risk through a formal mechanism such as a captive or by using parametric solutions in addition to traditional insurance.

Overall, organizations are far more familiar with captives and how they operate than they were even three years ago. Further, legislation in some countries has changed to accommodate the use of captives, making them a more broadly available option.

Using captives to access the reinsurance market is also on the rise. Reinsurers can be less restrictive in their underwriting approach, which sometimes provides more flexibility in terms and conditions than the primary market. This practice has grown among many companies, particularly in the natural resources, industrials and manufacturing, and retail and consumer goods sectors: combined, these sectors contributed to a 46 percent increase in ceded premiums between 2022 and 2023.1

Traditionally, captives are used for high-frequency, low-severity risks such as primary casualty or for the management of new or emerging risks where there are gaps in the insurance market. Now we are seeing growth in the strategic use of captives as companies look for more ways to optimize their total cost of risk.

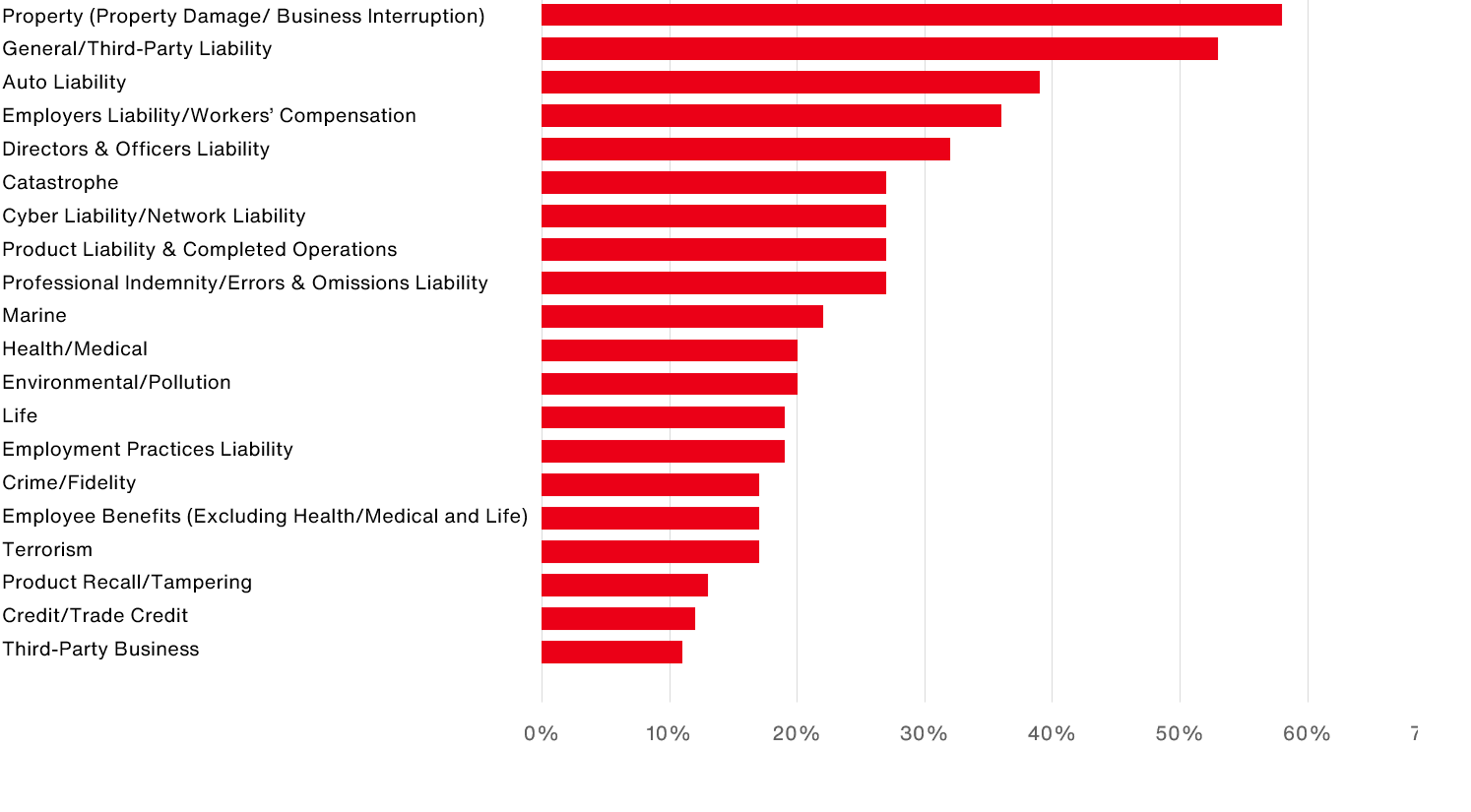

Property damage and business interruption continue to be the most prevalent lines of business written by captives, but we have seen premium volumes increase across all liability lines — general liability, workers’ comp and auto, in particular — in response to difficult market conditions.

A growing number of survey respondents (more than a quarter) indicated that they underwrite cyber in their captives. Indeed, among captives under Aon’s management, we have seen premiums for cyber grow significantly, up 58 percent from 2022 to 2023 alone. Although we are seeing a stabilization of rates for cyber, the inherent volatility of cyber risk and the ability to directly access reinsurance for cyber risks are contributing to an increase in the utilization of captives for this type of risk.

Collection

Capacity in the primary insurance market has disappeared altogether for some risks in certain geographies. Wildfire exposure is one example: massive losses have impacted the market, and some insurers have pulled out of this risk. This has constrained many companies’ options, with some buying less coverage or forgoing insurance because of prohibitive costs. As a result, captives and protected cells are increasingly being used to facilitate access to capital market capacity. As another example, our data shows material growth in captives writing environmental liability, up 114 percent in 2023, with the majority coming from the natural resources industry.

As the cost of medical insurance has continued to soar, multinational organizations have started to consider their captives as a potential funding source for wellbeing initiatives. A captive that reinsures employee benefits has the potential to mitigate the medical trend risks, and an effective way of doing this is often via wellbeing initiatives that will have a positive impact on future claims costs.

The number of captives has continued to increase steadily since 2020, and this growth is expected to remain on an upward trajectory as organizations continue to seek alternative risk financing structures in conjunction with their traditional risk transfer programs. Although insurance premiums in certain risks are beginning to moderate, they are still high compared to previous years, making captives an attractive option for companies seeking more control over their risk financing program.

As more companies become comfortable using captives and understanding the value they add, captives are likely to become further embedded into corporate risk strategies, regardless of market conditions. Captive owners continue to value captives as a means of providing the innovation and flexibility they need to cover risks that are not readily insurable on the direct market.

1 According to data from Aon’s 2024 Captive Benchmarking Survey

General Disclaimer

This document is not intended to address any specific situation or to provide legal, regulatory, financial, or other advice. While care has been taken in the production of this document, Aon does not warrant, represent, or guarantee the accuracy, adequacy, completeness or fitness for any purpose of the document or any part of it and can accept no liability for any loss caused by reliance on it. Any recipient shall be responsible for the use to which it puts this document. This document has been compiled using information available to us up to its date of publication and is subject to any qualifications made in the document.