Podcast 23 mins

Better Being Series: Understanding Burnout in the WorkplaceOur Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

The construction industry is under pressure from interconnected risks and notable macroeconomic developments. Learn how your organization can benefit from construction insurance and risk management.

Stay in the loop on today's most pressing cyber security matters.

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Explore Aon's latest environmental social and governance (ESG) insights.

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Explore our hand-picked insights for human resources professionals.

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Our Pay Transparency and Equity collection gives you access to the latest insights from Aon's human capital team on topics ranging from pay equity to diversity, equity and inclusion. Contact us to learn how we can help your organization address these issues.

Forecasters are predicting an extremely active 2024 Atlantic hurricane season. Take measures to build resilience to mitigate risk for hurricane-prone properties.

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

Better decisions for a better world. Explore Aon's environmental, social, and governance impact.

Aon is committed to driving commercial and societal action to help the transition to a net-zero economy and improve resilience in a changing climate. Our ESG strategy is focused on three major areas of environmental impact:

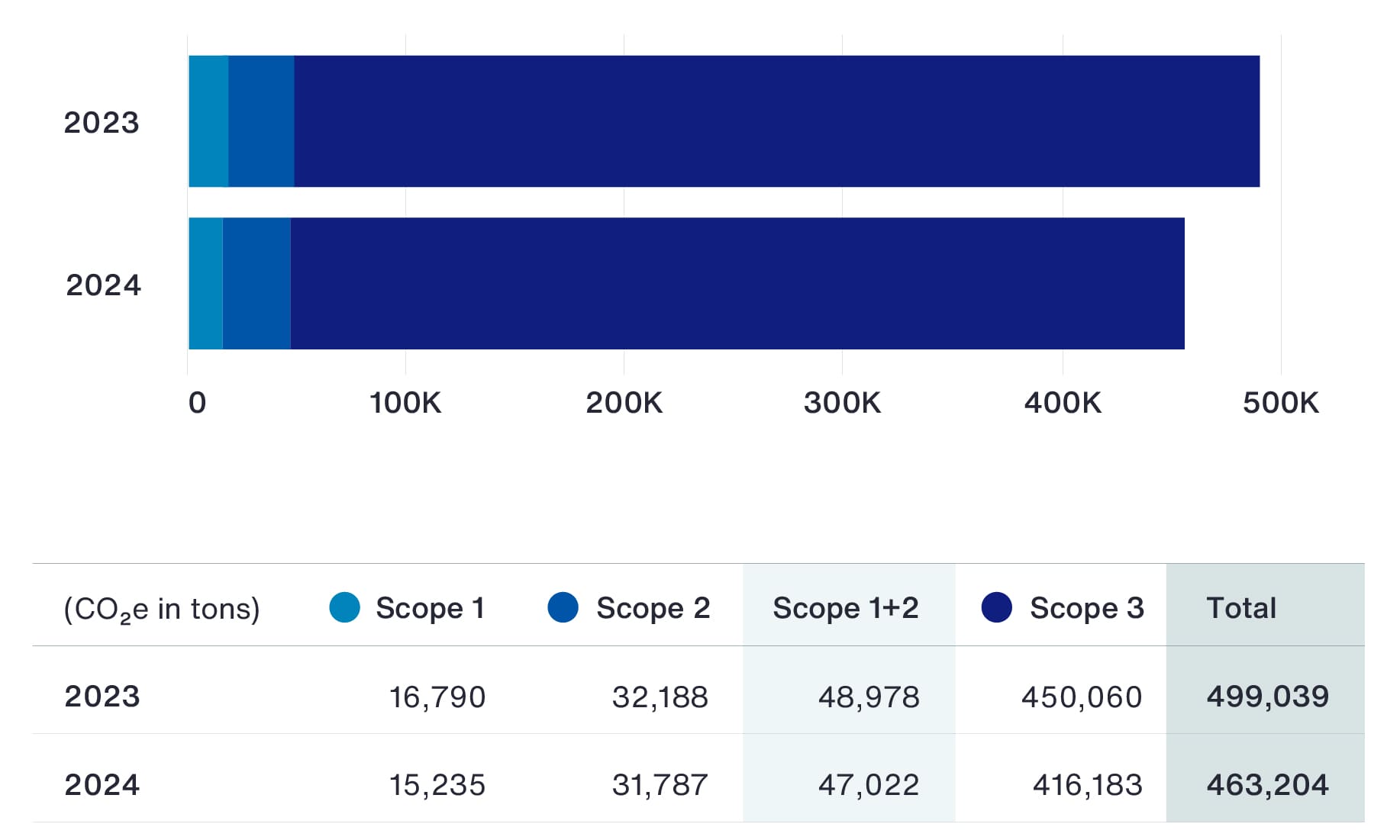

In 2024, Aon drove meaningful progress toward minimizing our impact on the environment and achieving a more sustainable future. We publish our progress through an annual report to the Carbon Disclosure Project.

At Aon, we are passionate about managing sustainability and proud of the steps we’ve taken in recent years to reduce our environmental impact by leveraging our one-firm Aon Business Services operating platform, all while advising our clients as they work to achieve their own environmental goals.

As part of our commitment to sustainability, we have set ambitious targets, including a commitment to achieving net-zero GHG emissions. We also regularly evaluate the latest market developments and scientific insights to ensure our goals, practices and priorities reflect the evolving sustainability landscape and support our ability to drive meaningful progress.

We recognize that achieving reductions in Scope 3 emissions is significantly influenced by factors outside our control, including the complexity of expanding supply chains and the slower-than-expected development and accessibility of innovative low-carbon technologies. As a result, we are focused on achieving net-zero by 2030 for Scope 1 and 2 emissions, which are attributable to our own operations, alongside our efforts with our colleagues, clients, suppliers and other stakeholders to further reduce our shared impact on the environment.

These efforts are aligned with our Environmental Policy, which reinforces our pledge to pursue sustainable business solutions and provides a global framework and controls for responsible operations. As part of this process, Aon has completed a physical and transition risk analysis, in which we looked at the current and long-term climate risks and impact on biodiversity in the areas where we operate. For additional information, please see Aon’s Task Force on Climate-Related Financial Disclosures (TCFD) disclosure.

We recognize the critical role our suppliers play in helping Aon reduce Scope 3 emissions associated with our purchased goods and services. Our Sustainable Procurement Program seeks to engage and support our suppliers in their own decarbonization journey while setting measurable targets for — and tracking the progress of — our enterprise-level suppliers.

We have embedded sustainability into our procurement category management strategy, working with top emitting suppliers to understand and advance their environmental targets and reporting. We expect our suppliers to reduce their environmental impact, set environmental targets and regularly provide progress reports to our firm.

We believe inclusive sourcing plays an integral role in supporting the needs of our stakeholders to create long-term value and industry leading Risk Capital and Human Capital capabilities for our clients and communities. Responsible procurement is a set of processes whereby we seek to foster engagement and source from historically underused population groups and service providers. We routinely source local and small business enterprises within the professional services industry with operational capacity to support small to large-scale or highly specialized projects.

Through our integrated procurement efforts, local and small suppliers represented more than seven percent of our U.S. addressable spend in 2024. For more than four decades, economic inclusion activities have evolved from being compliance-driven to being a fully collaborative strategy for doing business and meeting organizational financial objectives. Aon is the only industry-leading reinsurance broker serving as a national corporate member and annual conference sponsor of the National Minority Supplier Development Council and Women’s Business Enterprise National Council.

We have also taken steps to centralize our third-party spend, which contributes to greater efficiency and transparency. This enables our firm to manage our procurement spend more effectively with respect to our overall goals while also focusing on our emission reduction target. Within Aon Business Services, we continue to digitalize processes, achieving greater efficiency and accuracy and client satisfaction — all while reducing emissions. As one of the first signatories to the Sustainable Markets Initiative Insurance Task Force’s Global Supply Chain Pledge, Aon continues to aim to drive greater sustainability across insurance industry supply chains.

“Creating winning partnerships is extremely important to us,” said Melissa Salo, chief procurement officer for Aon. “It means that we can work together to have a greater impact and build a clearer path to a more sustainable future.”

About Aon

Our Real Estate strategy focuses on providing our colleagues with agile space in an open floor plan. In many cities, we have consolidated from multiple offices to an individual location so that we can better align with our Aon United strategy. We are also sourcing green energy, looking for energy efficiency improvements and assessing other opportunities to reduce our physical impact.

In 2024, in collaboration with Aon Business Services, we continued to use electronic invoicing and purchase orders, badge printing and electronic signatures. Collectively since 2013, these initiatives have saved numerous resources:

sheets of paper

kilograms of CO2e

liters of water

trees

We are also reducing our impact by moving from hard copies of Certificates of Insurance and Policies to e-delivery.

As we expand the use of green materials in our offices, we are working with partners to improve purchased product life cycles and responsible end-of-use equipment practices. We have moved from ownership to leasing of hardware through our third-party partners, which enables end-of-life recycling for printers, print cartridges and laptops. Our office products are increasingly refurbished to reduce waste. We also donate to local communities to extend the life cycle of materials and products.

In the U.S., Aon has donated extensively to the Chicago Furniture Bank. Hundreds of items such as filing cabinets, office chairs and tables have been redeployed through various channels to support those in need. Items such as filing cabinets will have new life as dressers for storing clothing. Local food banks also use our furniture to provide extra storage capacity for food distribution.

Additionally, Aon’s strategic approach to our colleagues’ working locations is designed to maintain the highest levels of client service and collaboration while enabling more purposeful decisions regarding travel and real estate. Colleagues and managers work together to determine the best option for working, whether that be remote, in the office, at a client’s office or in a combination of the three.

By investing in virtual technology, we are able to make progress toward our net-zero ambitions while connecting our global firm and bringing the breadth and depth of our expertise to each other in more efficient, modern ways. Our thoughtful approach also allows our clients to choose how we connect with them and reduce their own footprints through more sustainable decisions on travel.

The Voluntary Carbon Market (VCM) can be an impactful tool to attract private sector finance for nature conservation and restoration projects. However, in some countries, private financing through the VCM has been hindered by market transparency issues and compliance problems.

Insurance is therefore critical in maintaining buyer confidence in the VCM and in nature-based carbon projects, in particular.

To support scaling of the VCM and high-quality project development, Aon collaborated in 2024 with Future Climate, a not-for-profit organization that works on climate resiliency policy and delivery programs, to build a marketplace to support scaling of the VCM and high-quality project development. This marketplace enables any buyer to take out an insurance policy to protect their investment in the event of non-delivery due to risk factors, including natural catastrophes.

“Without proper infrastructure and de-risking mechanisms in place, it is nearly impossible to attract the scale of institutional investor capital that the Voluntary Carbon Market requires for a meaningful progress towards net zero,” said Natalia Moudrak, managing director for Climate Risk Advisory at Aon. “We are working with Future Climate to help shape better decisions in this area, while exploring solutions that decrease potential volatility and build resilience. By integrating risk and insurance considerations into the project development cycle at an early stage, Future Climate is helping to ensure the best possibility of success for projects in this space.”

We have focused our commercial real estate strategy on reducing our carbon footprint in all new working space projects.

Aon’s global headquarters in Dublin at Fifteen Georges Quay is designed with people at its heart and with a strong emphasis on supporting thoughtful working, sustainability, health and wellbeing. This new workplace consolidated two Aon offices in the city and brought 600 Aon colleagues together in one of the most energy-efficient buildings across our global footprint.

Our 30,000 sq ft workplace enabled a 44 percent reduction in space compared to the two previous offices combined and has resulted in a 60 percent decrease in annual emissions from 164,000kg CO2 equivalent to 68,000kg. The office’s electricity supply contract will be completely renewable in 2025, consuming approximately 89 kWh of electricity per square meter, compared to the Aon EMEA average of 171 kWh per square meter.

In 2024, Aon’s offices in India launched a sustainable colleague transport program with ARC Electric, an electric vehicle (EV) startup. The program is helping to replace traditional fossil-fueled cabs and provide eco-friendly travel options to Aon’s staff in India, all while advancing Aon's commitment to sustainability.

Throughout 2024, ARC Electric supplied Aon India with EV cabs that travelled approximately 490,000 kilometers, resulting in a reduction of about 62,000 kg of CO2 emissions — the equivalent to saving 2,350 trees. When those total emissions are added to the other sustainable transport programs run by Aon for our Indian colleagues, our firm realized an overall reduction of 900,000 kg of CO2 — the equivalent of 3,450 trees.

Aon colleagues play an integral role in our approach to decarbonization and we continued our education efforts in 2024 to help colleagues learn more about environmental impacts and how our firm, our colleagues and our clients are making a difference.

Inspired by a local family's efforts to clean up ocean plastic waste on Okinoerabu Island in Japan, Aon’s CEO of Japan Jake Yamamoto launched the Go! Blue campaign in 2019 to promote ocean conservation.

Through the initiative, our colleagues in Japan take part in various conservation activities, including eco-friendly product promotion, educational collaborations, colleague engagement activities and a children's Trash Art Contest. Our colleagues also participate in Go! Blue-organized beach clean-ups and workshops.

In 2024, Go!Blue expanded its reach and impact with Aon offices in South Korea, Hong Kong, Taiwan, Singapore, Indonesia, Australia, Vietnam and India running or planning their own related projects.

The campaign has also secured partnerships in 2024 with external organizations, including the Association for the Promotion of International Cooperation and the Japan International Cooperation Agency — on top of its existing partnerships with Sophia University and the Japan Federation of Catholic Schools.

Finally, a Go! Blue display case has been installed in client meeting rooms and the staff social area at our office in Japan, providing an opportunity to raise awareness of the campaign with clients and colleagues.

The Aon Spain Foundation, a nonprofit body formed by a group of Aon colleagues, works to identify, measure, understand and help prevent damage from natural catastrophes.

At the ninth symposium of the foundation’s Catastrophe Observatory, held at the Engineering Institute of Spain in November 2024, the Foundation released its annual Barometer of Natural Catastrophes, with 180 people attending the event and 500 more watching online. The report analyzes the costs and causes of the biggest disasters in Spain in 2023 and included indexes and metrics of critical infrastructure resilience and social vulnerability, as well as the impact of disasters on Spanish historical and cultural heritage and the study of artificial intelligence tools and their application in disaster prevention, response and recovery.

The symposium followed the devastating floods and storms in eastern Spain in October 2024 that resulted in the deaths of more than 200 people and substantial property damage. To recognize the efforts of the many anonymous people that helped rescue survivors and clean up after this and other catastrophes, the foundation awarded the Observatory´s Distinction to the “unknown volunteer.” Civil Protection and Emergencies of Spain collected the commemorative plaque on behalf of all the people who have given their time and effort to assist the victims.

Also at the event, Aon Iberia colleagues, the Aon Foundation and the Aon Spain Foundation presented donations to the Spanish Red Cross and Caritas to help survivors of the October floods and storms.

As a firm, Aon is a leading provider of data, analytics and expertise for clients around the world as they become increasingly affected by climate change and shifts in regulations.

Our focus is on helping our clients prepare for – and respond to – the challenges posed by the impact of climate change and unlock opportunities driven by the transition to a lower-carbon economy. In 2024, we received the Climate Risk Modelling Solution of the Year award at the Insurance ERM Global Climate Risk & Sustainability Awards in recognition of our industry-leading capabilities and team.

Effectively quantifying risk is a key step in managing it, and we have developed solutions to help our clients understand the scale and nuance of climate risk. Our ImpactOnDemand platform gives clients real-time alerts about potentially catastrophic climate events. At the same time, our catastrophe modeling and climate projections, driven by our collaboration with academic institutions, provide organizations with an informed view of future risks.

By understanding the size and type of the risks they face, clients are then able to prioritize and understand how their approaches should be part of their broader business strategy. We support them through risk mitigation and transfer solutions — including parametric insurance and catastrophe bonds — that are designed to help clients reduce the protection gap associated with physical climate risks. Our work in assisting our clients with their reporting and disclosure also helps our clients as they integrate climate risk into their decision-making processes.

Natural catastrophes are increasing in frequency and severity which, in turn, makes property risk finance increasingly complex.

To protect their operations and manage property risks, it has become increasingly important for businesses to select the best insurance program and for brokers to have analytics at their fingertips to drive options and guide their clients.

In 2024, Aon launched the Property Risk Analyzer, a digital application that assesses risk and optimizes a property insurance program. By modeling risk scenarios based on location-specific information, our Property Risk Analyzer gives brokers the technology to change the conversation about risk and help clients make more informed decisions.

The analyzer uses data visualizations to highlight concentrations of risk, allowing businesses and brokers to explore all key characteristics of a property. Meanwhile, a loss analysis function shows risk potential by peril and region, including the probability statistics and average annual loss projections to help clients make location decisions.

Aon’s Property Risk Analyzer helps clients and brokers confidently make and articulate better data-driven risk decisions — and maximize the value of their property insurance programs.

A large global investment organization based in Sweden selected Aon in 2024 to assess the climate risk across the company’s private capital portfolio.

Bringing together experts from across the company, Aon leveraged both its natural catastrophe and climate models to quantify physical climate risk to help the client understand which perils present the greatest risk to its for more than 7,000 individual asset locations around the world.

For the first time, the investment organization has visibility of physical and transition risk across its portfolio, which will inform its climate risk strategy and assist in deal due diligence.

In helping our clients transition to lower-carbon practices, Aon prioritizes cost reduction, risk management and strategies to unlock new investment opportunities. Aon’s focus on identifying potential risk exposures helps clients mitigate risks as they invest in well-established and emerging forms of renewable energy, including green hydrogen, long-term energy storage, electric vehicles and carbon capture and storage.

Our work across multiple dimensions of risk — including reputation, litigation and other transition risks — provides our clients with the guidance they need to reduce volatility and responsibly transition assets and portfolios from brown to green energy.

Across the U.S, wildfires caused by broken and fallen power lines can be more destructive than other ignition sources.

With the risk of litigation increasing, an energy provider contacted Aon about its liability and accessing insurance capacity to protect its credit worthiness.

Aon’s Climate Risk Advisory and analytics experts from across Aon’s Risk Capital (Commercial Risk and Reinsurance) team created a tailor-made model that would help it better understand the risk of wildfires caused by power lines — which proved vital in its insurance negotiations and enhanced risk management strategies.

As part of our effort to help clients advance ESG strategies and objectives, we have developed thought leadership and execution capabilities related to captives that help clients address, manage and finance risk.

Our report, Using a Captive Insurance Company to Drive Positive ESG Outcomes, provides guidance for using captive insurance to support sustainability objectives through underwriting, investment, risk management and risk improvement, societal resilience and transition support. The report also discusses ways to embed ESG and sustainability concerns in a captive insurance strategy, including best practices, key considerations for organizations and captive boards and a captive ESG model. Additional Aon thought leadership on captives discusses considerations such as underwriting strategies, risk retention and determining premiums.

Aon is a member of the United Nations Environment Programme Finance Initiative’s (UNEP FI) Principles for Sustainable Insurance initiative, which offers a framework for addressing ESG in insurance, and outlines ways a captive insurer can support sustainability.

Aon supports its clients in the transition to a lower carbon economy, which can create new growth opportunities and a more sustainable future. A comprehensive set of solutions — including bringing together risk and capital to enable decarbonization and clean technology — can help our clients innovate and advance their goals.

Aon is also playing a key role in helping the insurance industry formulate a consistent, forward-looking pricing model for new risks and large-scale complex projects.

Our clients are increasingly focused on realizing more responsible, sustainable investments amid a changing regulatory landscape to drive long-term value and effective risk management.

Aon has been a global signatory to the Principles for Responsible Investing since 2009 and our UK Advisory and Fiduciary Wealth businesses are signatories to the UK’s Stewardship Code.

In January 2022, we launched Aon’s Sustainable Multi-Asset Credit Fund, providing clients with exposure to a diversified fixed income portfolio that works to align with the United Nations Sustainable Development Goals and provide financing to companies working to mitigate climate change.

Aon’s Sustainable Multi-Asset Credit Fund currently has nearly £359 million ($437 million) under management and combines our long and successful track record in fixed income investing with our extensive expertise in responsible investing.

This is the second fund on our platform, after Aon’s Global Impact Equity Fund (nearly £386 million ($470 million) under management), that goes beyond integrating environmental, social and governance principals into the investment process.

Improving climate change requires a coordinated, targeted effort across geographies, governments, businesses and other stakeholders. We have convened high-impact partnerships and collaborations that are helping to identify solutions to some of the critical barriers.

During New York Climate Week in 2024, Aon brought together leaders across industries for a Risk and Resilience Summit to explore the critical role of the insurance industry in generating climate solutions. Featured panelists, including George Oliver, CEO of Johnson Controls, and Henri Bruxelles, chief sustainability and strategic business development office at Danone, addressed the strong potential for cross-sector collaboration to accelerate climate innovations and underscored the role of insurance as a backbone of economic stability and progress.

Attendees at the Summit also discussed the increasing risk of un-insurability due to climate and extreme weather events and emphasized the importance of collaboration and data-led insights to drive solutions.

Tackling the complex and interrelated challenges of nature and climate resiliency will require a great deal of public-private sector collaboration and cross-industry knowledge exchange. Aon aims to contribute to this evolving space through its contributions to the Taskforce on Nature-related Financial Disclosures data catalyst initiative, the ClimateWise nature and insurance working group, UNEP FI and other relevant forums.

We partner with organizations that align with our client needs and our capability to help unlock capital and drive better data-driven decisions. Aon invests in partnerships and talent from which we can draw on the expertise of climatologists and risk engineers to help our firm evaluate models and assess risk transfer for renewable energy projects and deliver sustainable solutions for our clients.

Our collaborations with top climate academic researchers enable our firm to bring scientific insight to catastrophe impact forecasting, quantification of climate risk in (re)insurer portfolios and better decisions on pricing, investments and exposure management.

The International Federation of Red Cross and Red Crescent Societies (IFRC) provides vital, immediate funding for the National Red Cross and Red Crescent Societies when disasters strike — especially those smaller-scale emergencies that may not attract global attention.

Previously, the Federation’s Disaster Response Emergency Fund (DREF) has run dry before the end of the year, which prompted the IFRC in 2023 to work with Aon and reinsurers to secure a groundbreaking indemnity insurance policy — the first such arrangement for the humanitarian sector. The policy protects the DREF from volatility and increases its capacity to effectively distribute funds to those in need.

As expected, in September 2024, demands for disaster relief on the fund again surpassed its deductible threshold, but this time the shortfall triggered the policy’s first-ever insurance payout.

For the rest of the calendar year, further demands on the IFRC-DREF are covered by the insurance payout of up to CHF 15 million ($16 million), bringing essential funding to disaster relief programs in 10 countries, including Nepal, Mali, Niger, Algeria and Vietnam.

“At Aon, we believe funding should not stop emergency aid,” explains Aon’s former president Eric Andersen. “The IFRC-DREF insurance policy shows that the private sector can do more to support humanitarian organizations and our world’s most vulnerable populations.”

Africa is home to 65 percent of the world’s uncultivated arable land, according to the African Development Bank. But a lack of effective environmental data scarcity has prevented the expansion of agricultural crop insurance, stunting the growth of the agri-food sector. At the same time, smallholder farmers in sub-Saharan Africa are highly vulnerable to extreme weather events, with only 3 percent having effective crop insurance.

In 2024, to help increase crop insurance capacity across Africa, support smallholder farmers’ resilience and accelerate the use of nature-positive practices, Aon announced a unique collaboration with the African Development Bank (AfDB), Africa’s premier development finance institution, and Amini, a leading innovator in space technology and artificial intelligence.

Through this collaboration, Aon will use Amini’s farm-level data to support AfDB’s Africa Climate Risk Insurance Facility for Adaptation in its efforts to develop innovative de-risking solutions and assess and monitor the changing risk environment across the continent. Farmers would then use the data to make better-informed decisions, which leads to greater resiliency and yield improvements.

The collaboration is aimed at helping Aon clients with extensive supply chains or balance sheet exposure to the agricultural sector to better manage the multi-faceted impacts of climate risk.

In 2024, Aon joined with Lloyd’s of London and the United Nations Capital Development Fund (UNCDF) to launch a new disaster resilience vehicle that will provide disaster risk financing to small islands in the Pacific region.

Tapping into the global reinsurance market for capacity, the Global Disaster Resilience Vehicle, which is backed by members of Lloyd’s Disaster Risk Facility (DRF), is designed to improve recovery and increase disaster resilience for Fiji, Papua New Guinea and Samoa.

The vehicle will leverage donor funds committed to the region and use local networks to provide exposure-based payments directly to climate-vulnerable communities.

Dominic Christian, global chair of Reinsurance for Aon, said: “Providing access to risk capital to reinforce and augment the work of the UNCDF is an important step in helping the Pacific islands build resilience against natural disasters, and becomes even more important given the potential impacts of climate change.”

“Working with the UNCDF, Lloyd’s, and the DRF represents an exciting collaboration, and underpins our belief that combining our resources and expertise is the most efficient and effective way to develop an ecosystem for disaster risk financing that can benefit the countries and communities that need it most.”

We continue to build on actions and programs that support inclusion, workforce wellbeing and civic outreach to build an equitable culture.

Our own model is built for transparency and trust, helping us bring our purpose to life and create value for clients and colleagues.

We see significant opportunity in both enhancing our own ESG impact and delivering innovative solutions to clients and the wider market.