More Like This

-

Capability Overview

Mergers and Acquisitions (M&A)

Whichever way you cut it, global M&A in 2023 was lacklustre as deal value fell by around 17% year-over-year and deal volumes struggled to move the needle, despite the fourth quarter of 2023 registering relative improvement compared to the same period in 2022.

From the cauldron of necessity, however, a discernible correlation emerges between the drop-off in M&A and more positive developments in the M&A insurance market, as insurers strive to differentiate not only on pricing and coverage but also in more indirect ways: adding sector specialists to enhance underwriting and coverage and continuing to emphasize - understandably - claims record.

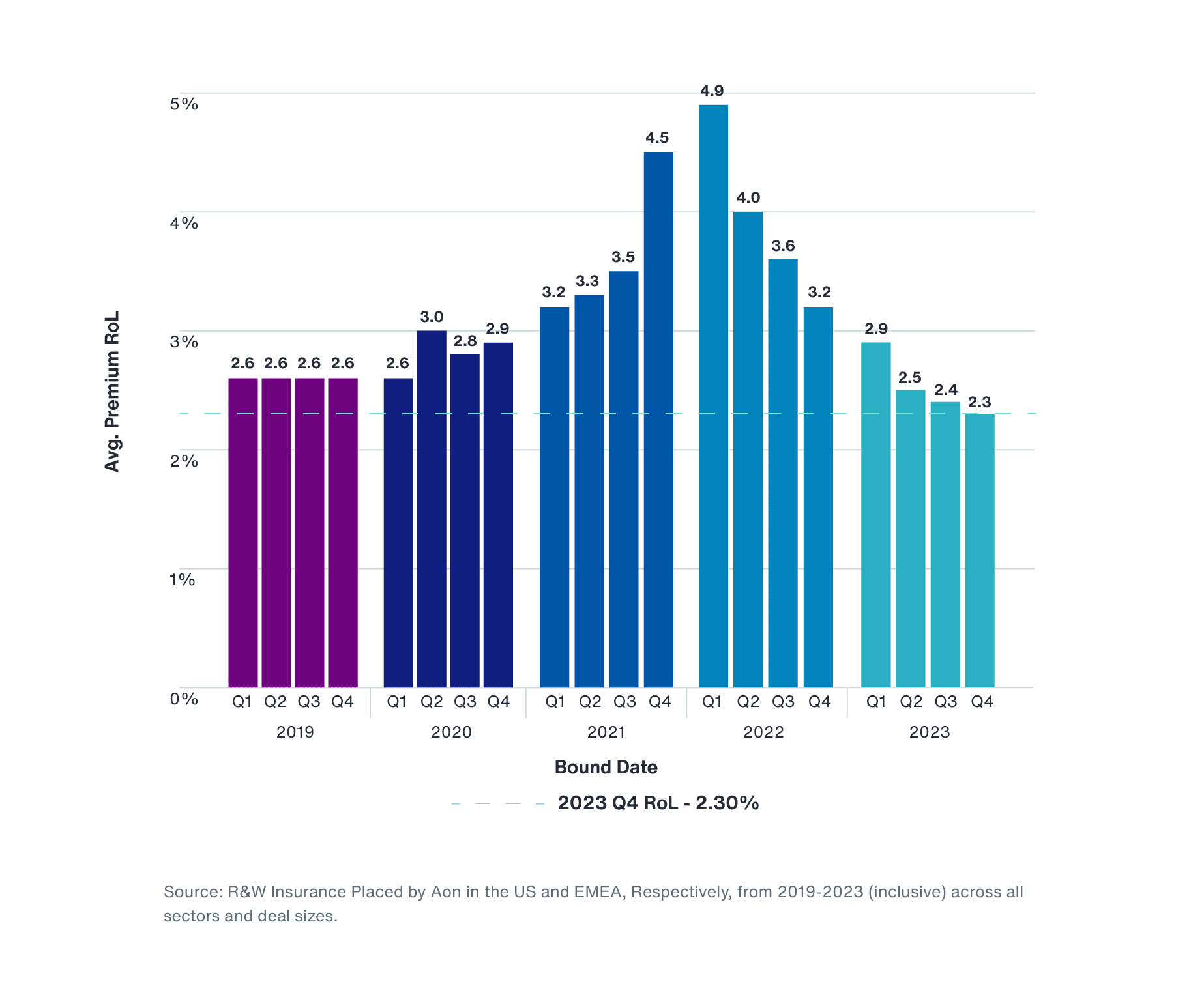

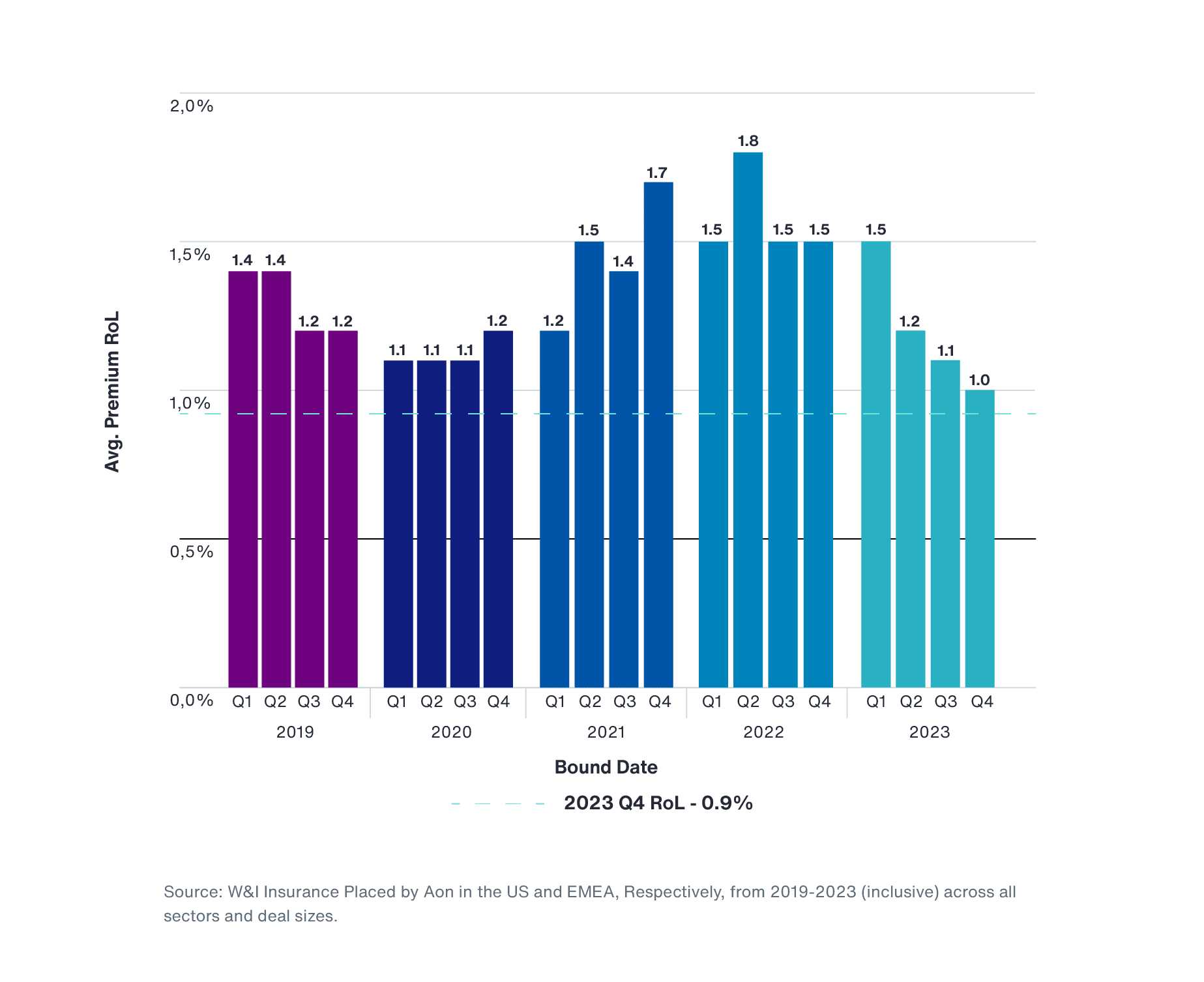

By the fourth quarter of 2023, both the U.S. and EMEA experienced the lowest average quarterly pricing1 recorded by Aon in the last five years - from before, during and since the pandemic - for R&W (2.3%) and W&I (1.0%) insurance, respectively (see figure 1).

This development is hardly surprising, given that the increased amount of risk capital flowing into the market in response to the post-pandemic spike has had to hunt harder for deals to underwrite as M&A volumes sank in 2023. As at Q2 2024, R&W and W&I pricing continues to remain highly competitive, with rates and retentions remaining favourable even as the pace of deals in the M&A market improves.

Aside from softer rates, positive client developments include improved underwriting capability as insurers in the U.S. and EMEA recruit talent with sector specialism in areas like technology and life sciences. This marks a key passage in the maturing of M&A insurance given that risk transfer, as a solution, has traditionally been sector agnostic -more designed simply to wrap the underlying deal. Acknowledgement by insurers that quality coverage plays a key part in competing on risk augurs well for clients.

As a result, underwriters show greater risk appetite and require fewer exclusions for certain sectors traditionally viewed as more challenging, such as financial services, energy and healthcare. We have seen typical exclusions - including for matters such as capital adequacy, cyber security, condition of assets and secondary tax liabilities - removed either where due diligence provides sufficient insight, or it can otherwise be shown that the risk has been sensibly addressed by the buyer (contractually, for instance).

Capability Overview

Mergers and Acquisitions (M&A)

Certain aspects of R&W cover have continued to feature more frequently on insured deals in EMEA, driven by continued inward U.S. investment and a desire for these buyers to transfer deal risk on terms with which they and their advisers are more familiar. A hybrid, 'trans-Atlantic' approach has evolved, which helps U.S. acquirers of EMEA assets effectively bridge their M&A insurance cover and adopt an investment protection approach more akin to their domestic deal practice and, as a result, bring greater execution efficiency. Specific accommodations to give these clients more of a R&W look and feel include data room 'scrapes' (i.e. disregarding general disclosure of the data room for purposes of the policy); removal of the policy de minimis; a broader definition of loss; and more streamlined specific warranty exclusions or amendments. While, traditionally, these features have often been linked to whether the underlying transaction documents more closely resemble a U.S. or European deal, insurers show continued flexibility, where appropriate, to offer enhancements on a 'synthetic' basis. This could include, for instance, a data room scrape even if the data room is 'Disclosed' in the transaction documentation.

With buyer diligence often going deeper and broader - cyber security, technology and ESG, to name a few - and parties taking more time to negotiate and execute terms in a leaner deal environment, the adage that better deal insights result in better deal protection certainly remains true. As we mention below, having one eye on relevant R&W/W&I claims experience when scoping diligence at the kick-off stage can help clients plan their deals and anticipate areas of focus, reducing the scope for unwelcome coverage surprises during the underwriting of M&A insurance.

Insurers continue to engage with ideas which either enhance existing solutions or expand how insurance can be applied to deals.

Interim Breach and Excess Solution (IBEX), recently launched by Aon, is an example of the former, covering breach of representation and/or warranty which both occurs and is discovered in between the signing and closing of the deal. Traditionally excluded from R&W and W&I insurance policies (save for rare exceptions), IBEX has gained in popularity as insurers demonstrate continued willingness to respond positively and help clients de-risk the pre-closing period of their deals.

An example of the latter can be seen in real estate M&A, where clients acquiring UK assets can now streamline W&I and title cover into a single Aon proprietary solution (ACRES), eliminating the coverage, cost and process inefficiencies of having different policies.

Claims2 performance is becoming a key differentiator, especially where there may be little daylight on terms and pricing in a tight deals market, and insights on an insurer's claims track record come to the fore to help clients make an informed insurer selection decision at the pre-underwriting stage. Many insurers also now produce their own claims studies to demonstrate that their policies will respond to, and pay out on, valid claims.

A more proactive claims approach is evident when issues surface post-acquisition, as clients look harder at their 'value protection on investment'; notably, 2023 saw two reported cases on W&I insurance claims in the English courts, with an even rarer appeal judgment on one of these being handed down in May 20243 which provides helpful guidance on how to interpret exclusions in insurance policies governed by English law and how the English courts will resolve alleged inconsistencies in both the language used and the contract as a whole.

As at Q2 2024, for Aon-placed policies we have now seen more than 1,000 claims filed in North America, and aggregate paid claims (net of deductibles erosion) of more than $1.25 billion for Aon clients in North America.

For the same period - as at Q2 2024 - in EMEA, we have seen approximately 300 claims for Aon-placed policies notified, and aggregate paid claims (net of deductibles erosion) of approximately $140 million for Aon clients in EMEA.

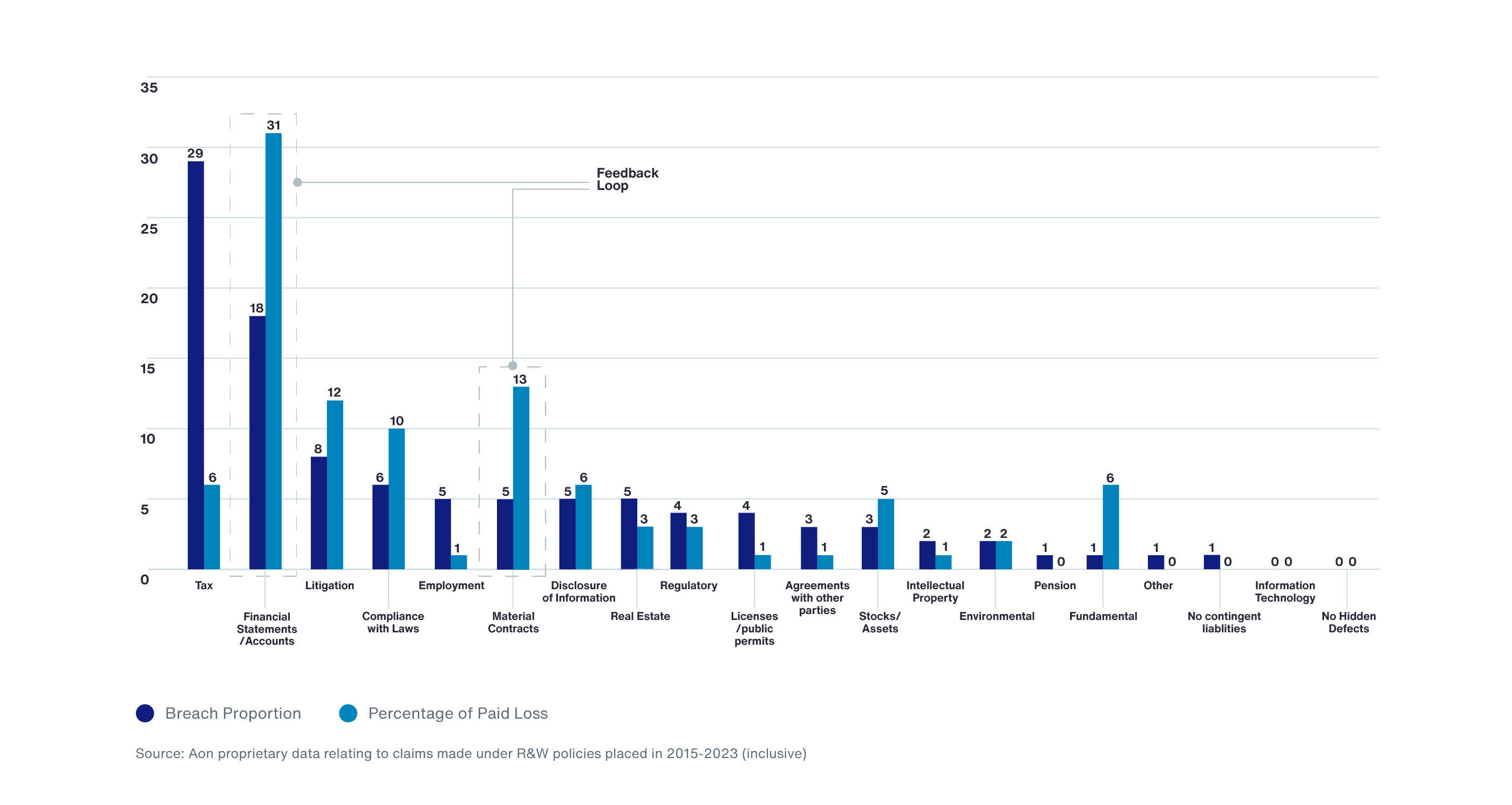

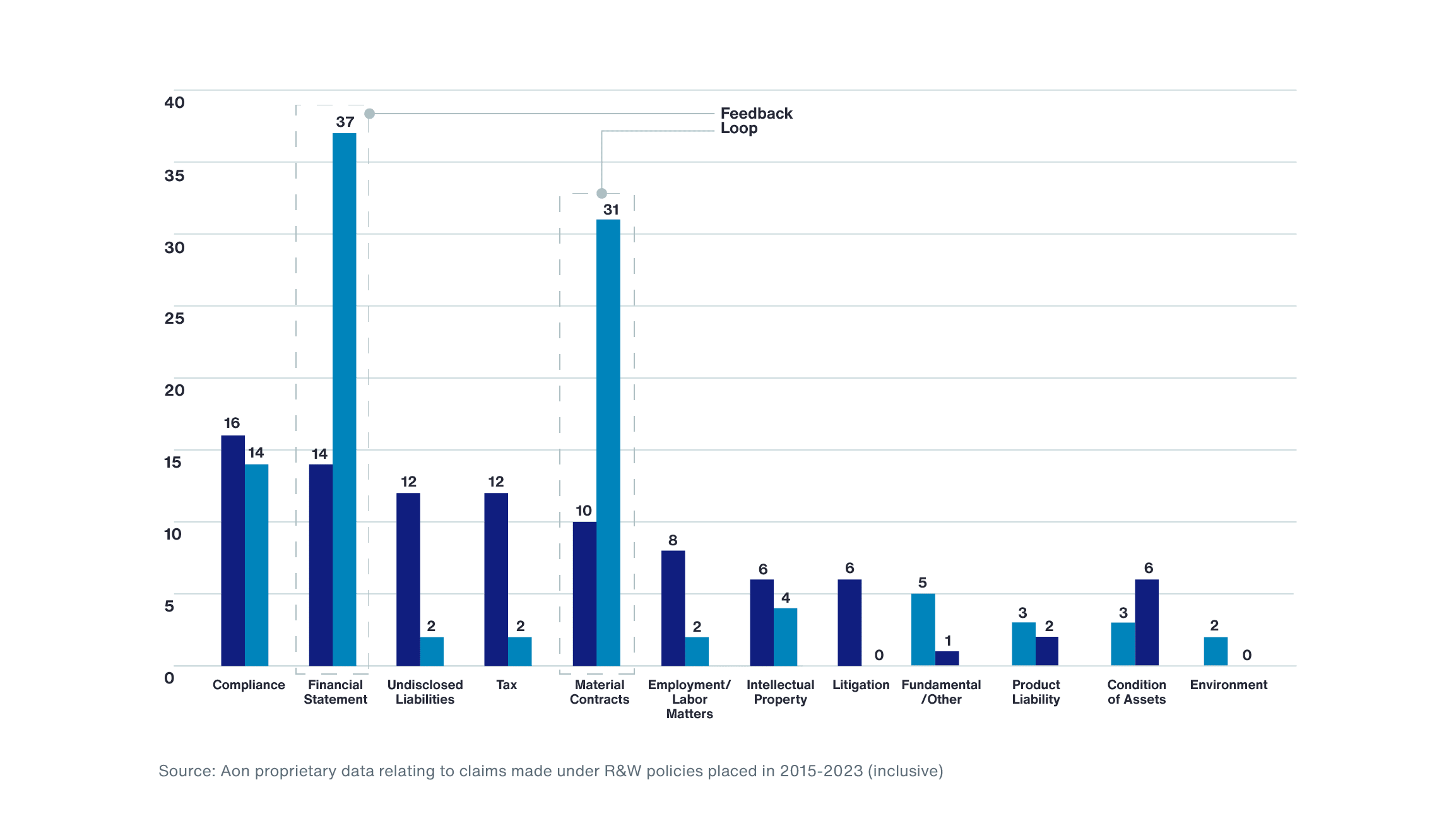

Figures 3 and 4 illustrate certain warranty hot spots based on Aon's claims data for the last seven and nine years for EMEA and the US, respectively. Broad categories of warranty which cluster the highest number of claims under both R&W policies in the US and W&I policies in EMEA placed by Aon are:

compliance with laws (16.3% US; 5.5% EMEA); financial statements (14.4% US; 17.8% EMEA); tax (11.5% US; 28.3% EMEA); and material contracts (9.9% U.S.; 5.0% EMEA)

In addition, a relatively high number of claims are made under R&W policies for breach of undisclosed liabilities representations (11.9%) in the U.S. and a relatively high number of claims are made under W&I policies for breach of litigation (7.8%) and employment (5.0%) warranties in EMEA.

There is some parity between the U.S. and EMEA in terms of average claims pay-out for certain types of warranty breach over the same seven- and nine-year period, with breaches of financial statements (37.0% U.S.; 30.9% EMEA) and material contracts (30.70% U.S.; 12.9% EMEA) attracting the most paid loss in both regions. It is notable that both these areas show a much higher proportion of actual claims paid relative to claims made, suggesting a lower claims volume but significantly higher financial impact.

Given that losses arising from breach of financial statements and material contracts tend to impact the purchase price paid for the acquired company (and loss may be claimable on a multiplied basis, depending on the European jurisdiction), it is perhaps not surprising that these warranties represent the biggest drivers of loss.

Given this pattern across both the U.S. and EMEA regions from this claims analysis, we suggest a valuable 'feedback loop' can be identified which helps clients and their advisers factor this experience into their diligence scoping and materiality thresholds at the kick-off stage for the next M&A deal.

Awareness of this feedback loop ensures not only that R&W/ W&I cover can be optimized for the client by positioning and calibrating the due diligence appropriately from the outset; it also means that some of the potential underwriting hotspots referred to under Coverage can be anticipated to achieve more efficient deal execution.

Tax insurance continues to be the go-to solution globally to address known tax risks excluded by R&W and W&I policies and today can also be used around the world to add certainty to tax outcomes facing companies and other tax-payers where there is no third party transaction, such as an internal corporate reorganization or transfer pricing concerns.

In the U.S., tax credits have long been a favoured way of incentivizing investment and part of the tax insurance landscape. In fact, protecting purchasers of investment tax credits in the 1980s was the objective of the original tax insurance policies. Today, the renewable energy industry is heavily relying on tax insurance as a means to facilitate the tax equity financing of renewables projects.

The recent enactment of the Inflation Reduction Act (IRA) in the U.S. is spurring huge growth in investments in renewable energy projects and has secured tax credits as one of the primary federal incentives to encourage investment in solar, wind, and other renewable energy asset classes. With the introduction of the ability to transfer the tax credits as a result of the IRA, we are now also seeing tax credit buyers and tax credit sellers protected by tax credit insurance.

As a result of the IRA, the amount of tax credits that are being insured on any given project are increasing primarily as a result of the new tax credit 'adders'.4 These adders allow for a project to qualify for a higher tax credit percentage than they otherwise would have prior to the passage of the IRA. Some of the types of adders available include projects that use domestic content (products produced in the U.S.), projects that are located in an 'energy community' (i.e., an area with significant employment related to coal, oil, or natural gas), and/or that the project is in a low-income community. Tax credit insurance is providing certainty that projects will qualify for these adders.

This article was written by Aon's M&A and Transaction Solutions team as contribution to the Global M&A Intelligence Report 2024 by DLA PIPER.

1 Determined as the cost of M&A insurance (premium) divided by the amount of insurance limit purchased, expressed as a percentage; also known as the 'rate on line' (note: this is not the all-in-client cost and does not fully include brokerage, insurer diligence fees and premium taxes).

2 Aon's Transaction Solutions Global Claims Study, published in May 2024, includes an analysis of Aon's proprietary claims data and results of its survey of the broader claims experience of insurers in both the US and EMEA, the first such analysis of its kind.

3 Finsbury Food Group Plc v AXIS Corporate Capital UK Ltd & Ors [2023] EWHC 1559; and Project Angel Bidco Ltd (In Administration) v Axis Managing Agency Ltd & Ors [2024] EWCA Civ 446 (02 May 2024).

4 A bonus to the amount of tax credit provided certain criteria are met.

General Disclaimer

This document is not intended to address any specific situation or to provide legal, regulatory, financial, or other advice. While care has been taken in the production of this document, Aon does not warrant, represent or guarantee the accuracy, adequacy, completeness or fitness for any purpose of the document or any part of it and can accept no liability for any loss incurred in any way by any person who may rely on it. Any recipient shall be responsible for the use to which it puts this document. This document has been compiled using information available to us up to its date of publication and is subject to any qualifications made in the document.

Terms of Use

The contents herein may not be reproduced, reused, reprinted or redistributed without the expressed written consent of Aon, unless otherwise authorized by Aon. To use information contained herein, please write to our team.

Our Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

The construction industry is under pressure from interconnected risks and notable macroeconomic developments. Learn how your organization can benefit from construction insurance and risk management.

Stay in the loop on today's most pressing cyber security matters.

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Explore Aon's latest environmental social and governance (ESG) insights.

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Explore our hand-picked insights for human resources professionals.

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Our Pay Transparency and Equity collection gives you access to the latest insights from Aon's human capital team on topics ranging from pay equity to diversity, equity and inclusion. Contact us to learn how we can help your organization address these issues.

Forecasters are predicting an extremely active 2024 Atlantic hurricane season. Take measures to build resilience to mitigate risk for hurricane-prone properties.

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

Article 7 mins

A variety of growing risks, including shareholder derivative actions, an evolving regulatory environment and bankruptcy filings, are why public and private organizations must protect their corporate directors and officers.

Article 15 mins

Organizations in EMEA face unprecedented challenges as cyber threats become more sophisticated. In the face of emerging AI, evolving regulations and geopolitical tensions, businesses should strengthen their resilience to better navigate the complexities of the digital age.

Article 6 mins

In a volatile climate, institutional investors are turning to outsourced chief investment officers to conquer administrative, regulatory and market challenges.