With the labor market normalizing and benefit budgets tightening, employers are shifting their focus to maintaining a

competitive position while managing healthcare costs. Aon’s 2024 U.S. Health Survey reveals a change in mindset.

Last year, companies aimed above the market, while now they just want to keep pace. One reason for this shift is

that employers had raised the bar over the past few years in order to compete, and now they are adjusting their

competitive expectations in a new environment.

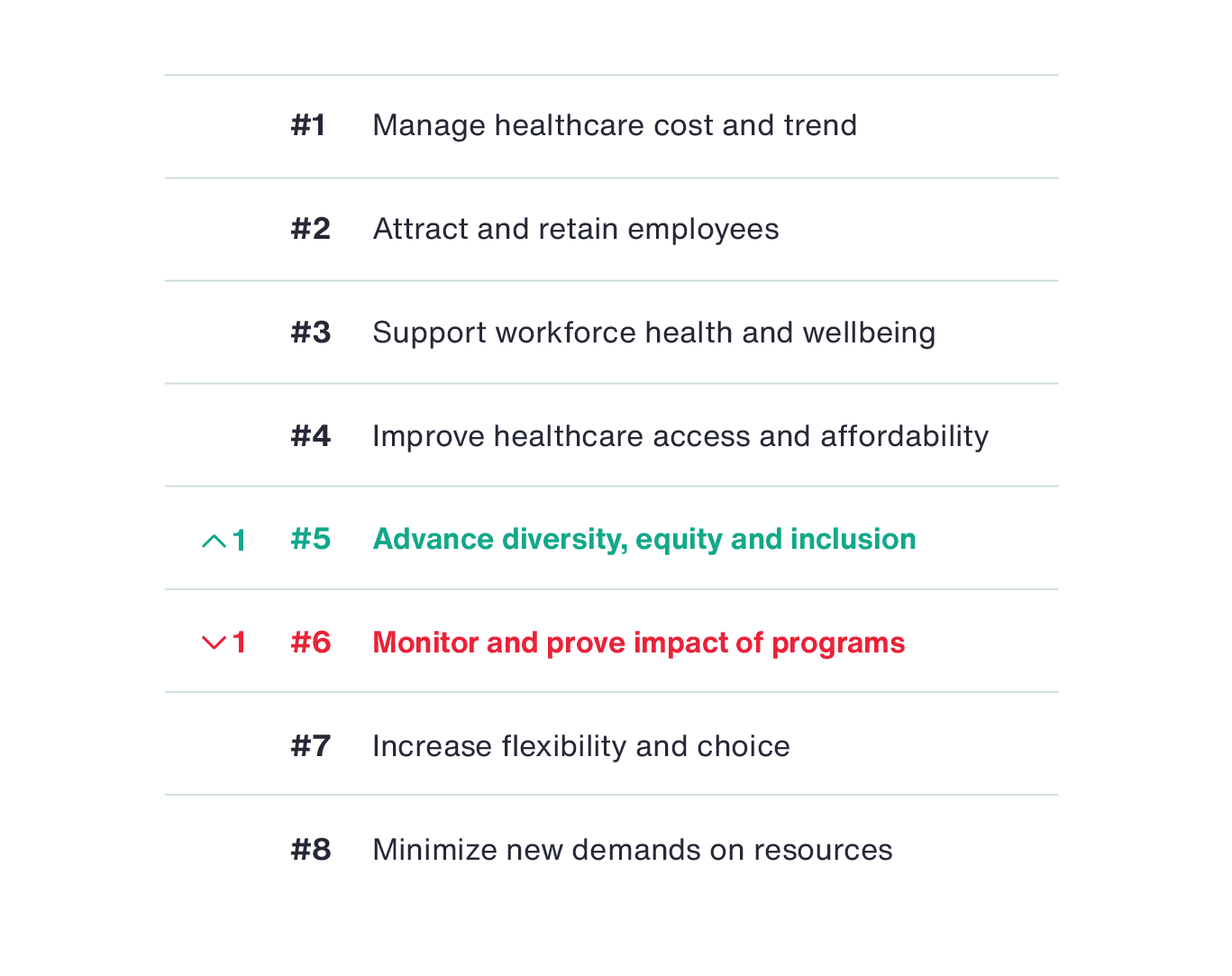

How Companies See the Role of Benefits Today

Investing in People While Managing Costs

Employers’ top priority in 2024 is to manage healthcare costs, which was ranked number one by 38 percent of

respondents (up five points from the 2023 survey). The next three priorities are all focused on investing in

benefits. They include, attracting and retaining employees, supporting workforce health and wellbeing, and improving

healthcare access and affordability. All four priorities haven’t changed in the past year. The competing pressures

to manage costs while investing in employees make it challenging for employers to find the right balance for their

benefits.

Over the next four years, Aon’s analysis shows healthcare costs are predicted to increase at a rate that is

four times general inflation, nearly three times wage increases and more than double the rate of retirement plan

contributions. Without significant action to rein in these costs, healthcare will consume an increasing share of

total rewards budgets.

Healthcare cost increases are impacting employees as well. Our research across employer sponsored plans shows that

one in five employees are spending more than 10 percent of their annual income on healthcare — including premiums

and out-of-pocket expenses.

The fifth business priority, moving up one spot from last year, is related to monitoring and proving the impact of

programs. According to a survey by Paychex, employers have increased their benefit offerings by 22

percent since the start of the pandemic. But that increased spend may not ultimately be achieving the intended outcomes.

The rising focus on monitoring and proving impact of programs is therefore expected to continue.

2024 Benefit Priorities

Analyzing the shift in benefit priorities in 2024 vs. 2023

How Organizations are Addressing Rising Healthcare Costs

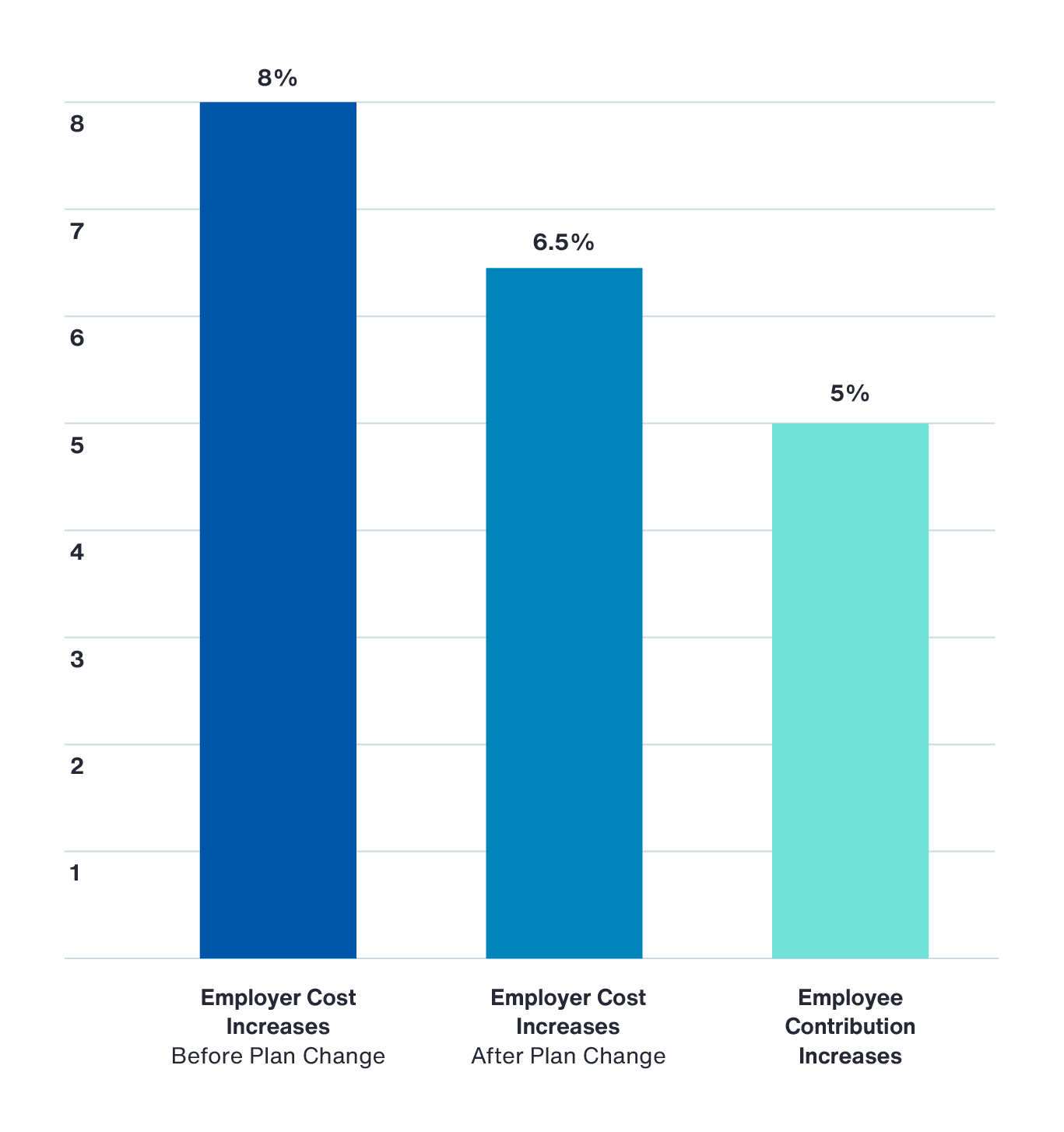

Healthcare costs are projected to increase 8 percent in 2024. However, through a variety of strategies,

like plan design changes and tighter management of prescription drugs, employers anticipate an increase of 6.5

percent. Despite these strategies to lower costs, healthcare is still trending much higher than the 4.5 percent

increase in 2023.

Projected Healthcare Cost Increases in 2024

In addition to the typical levers of increasing cost sharing through plan design and contributions, plan sponsors are

addressing rising costs through tighter cost management strategies, alignment with effective delivery partners and

more steerage to cost-effective care.

- Increasing employee cost sharing. More than one third of respondents said they are adjusting

their

contribution strategy, with a similar number citing plan design changes. It’s worth noting that no other tactic

was mentioned by more than 20 percent of respondents. Clearly, asking employees to share in cost increases

continues to be an important lever. Employers raised the amount that employees pay out of their paycheck for

healthcare premiums by 5 percent in 2024, more than double the 1.7 percent increase employees experienced in

2023.

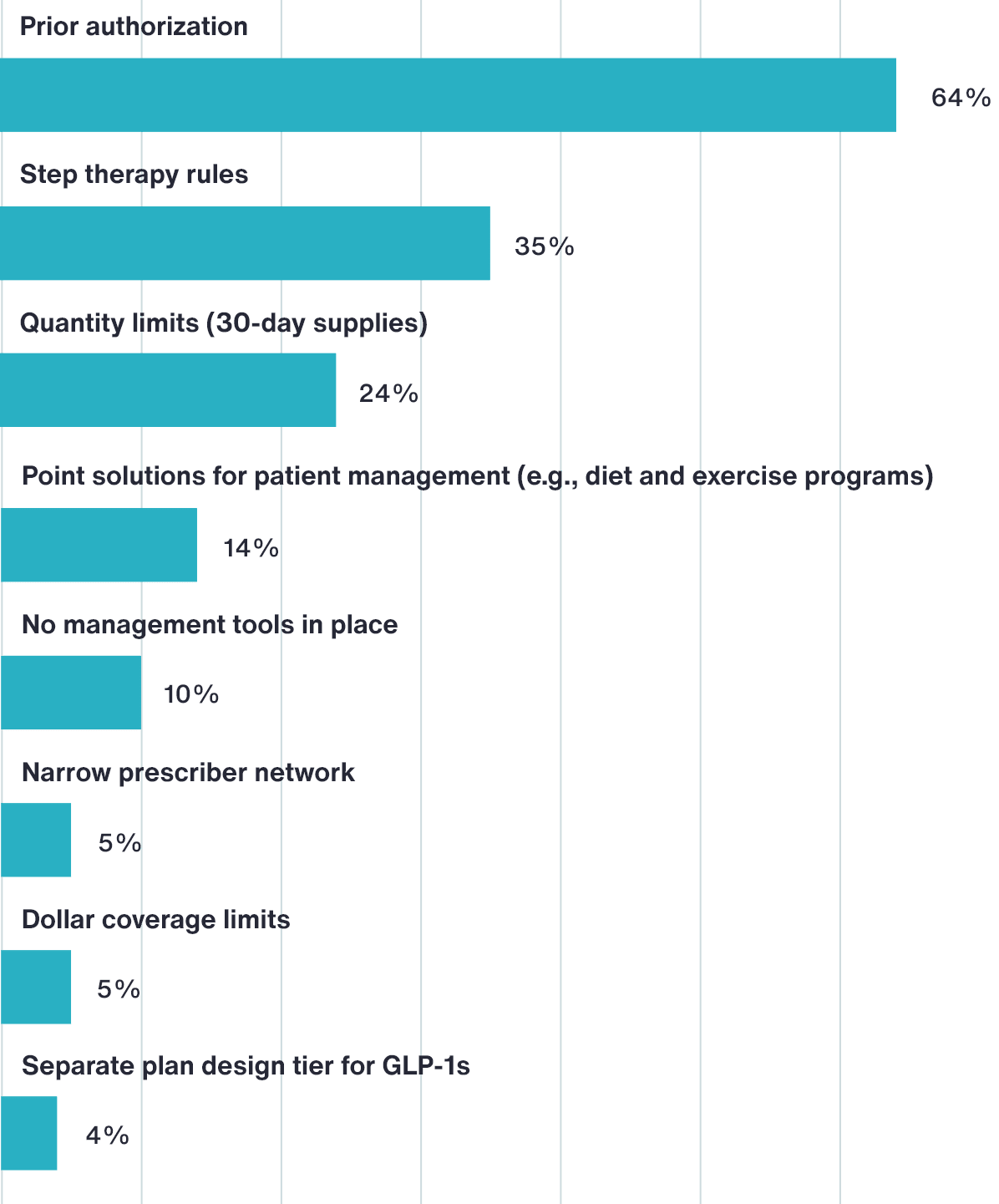

- Cost management strategies. Respondents cited marketing programs for cost and competitiveness,

tighter

prescription management, and implementing new condition management and prescription drug solutions as their top

cost management approaches for 2024.

- Focus on optimal care. Some employers are using plan design to incentivize virtual care. Others

are steering

participants to high-quality, low-cost providers through plan design or network changes.

While many companies are taking these steps to minimize costs, about one in five employers have still made no changes

to their plan.