The current macroeconomic challenges has led many to forecast a prolonged slowdown in private equity deal volumes and question whether the return levels of previous years can be sustained. Despite these

challenges, it is an opportune time for private equity firms to deepen their focus on value creation through

operational improvement and reduce emphasis on financial engineering to generate value.

A key pillar of an operational improvement strategy is working capital optimization which can create liquidity and

release short-term cash, as well as enable access to off-balance sheet financing and support de-levering.

The benefits of a sound working capital strategy are well documented. One of the most regularly cited studies on

working capital and firm performance concludes that ‘firms that converge to an optimal level of working capital

improve their stock performance and operating performance’1.

A lesser emphasized finding of the study is that freed up working capital was most often redeployed to fund

investment in revenue growth.

In other words, besides the liquidity and financing benefits, working capital optimization initiatives often have

second-order effects such as boosting sales growth, which can support the private equity firm’s value creation

objectives.

In fact, the strategic use of credit insurance solutions should be incorporated into the value creation playbook not

only to capture upfront liquidity advantages, but also for additional benefits that can actively support value

generation such as market expansion, procurement efficiency, and debt reduction.

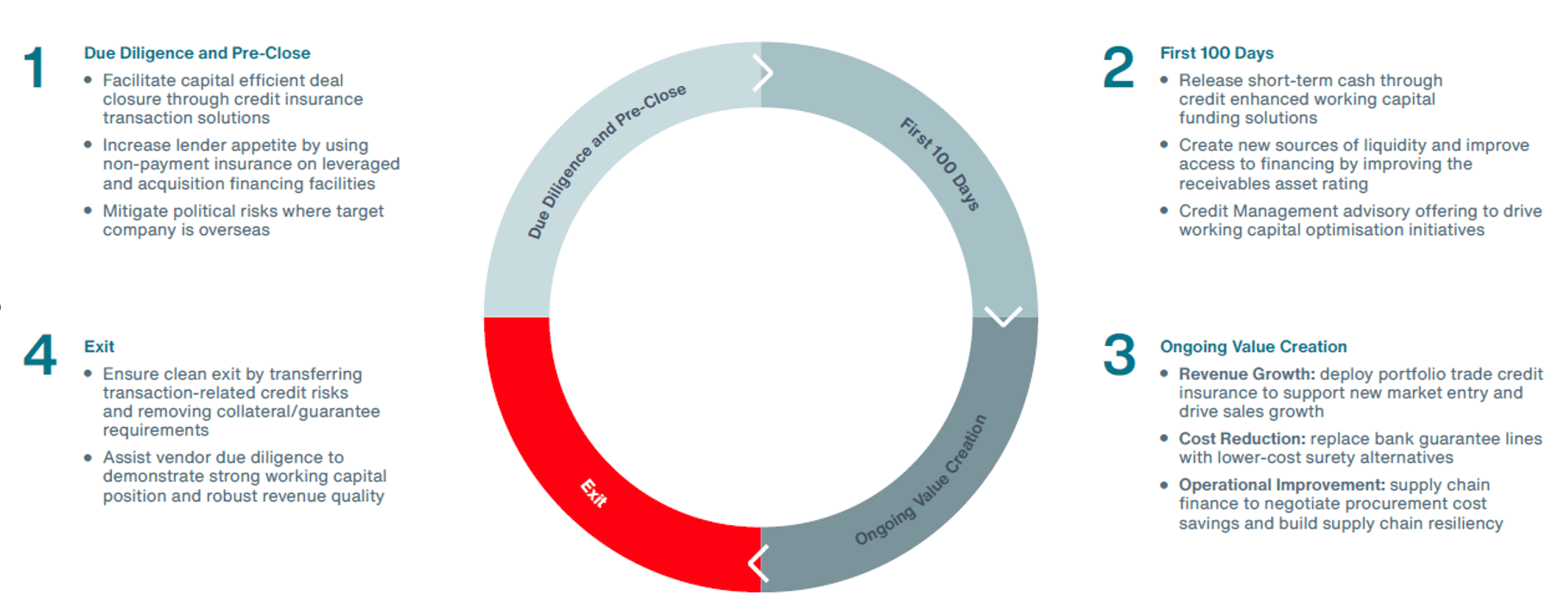

Whilst credit solutions can meet a range of strategic objectives across the investment life cycle (see schematic at

the end of the article), the post-acquisition role of credit solutions to drive private equity value creation

through working capital initiatives is the focus of this article.

The strategic use of credit solutions (credit insurance, political risk insurance and surety) can enhance liquidity,

improve transaction returns, facilitate capital-efficient deal closures, and support long-term value creation.

Corporate Treasury

1. Raise Off Balance Sheet Financing

During the first 100 days, a common workstream for the treasury function is to review, consolidate and optimize

existing sources of working capital bank lines. It can also be an opportunity to explore off-balance sheet financing

structures (subject to local accounting treatment) that can improve debt metrics, create financial flexibility and

prevent potential covenant breaches, while still maintaining access to the same level of financing lines.

The use of portfolio trade credit insurance to enable off-balance financing is a commonly used strategy by

sophisticated corporates and one that can be replicated by portfolio companies of all sizes. For relevant

industries, operating leases can be considered as they qualify for off-balance sheet treatment in certain

jurisdictions, and credit solutions can play a key role in credit-enhancing such leasing structures.

2. Leverage the Trade Finance Market

Portfolio companies can turbocharge growth through trade financing solutions that are designed to support sales and

revenue momentum. By looking beyond vanilla receivables financing, companies can evaluate the relevance of

distributor finance or warehouse/ inventory finance and understand whether it can support their business models and

deliver growth. Some of these solutions can also enhance the inventory component of the cash conversion cycle which

is often overlooked.

Credit insurers have deep experience with a variety of trade financing structures and can partner with lenders

resulting in cost competitive and bespoke trade financing solutions.

3. Create New Source of Funding

During the initial post-close period when there may be greater liquidity pressures, portfolio companies with

medium-tenor receivables (two to five years) can benefit from a large upfront injection of liquidity by financing

those receivables and deploying the cash to fund other value creation projects. Structured credit insurance can play

an important role here as it often increases lender risk appetite for medium tenor receivables financings and

potentially lowers overall costs.

An incremental benefit is that it also sets up a self-funding mechanism to support other value creation initiatives.

4. Preserve Existing Sources of Funding

In some sectors, the use of bank guarantees is required in the normal course of business, and this can take up a

significant portion of financing capacity and collateral.

Surety solutions are a meaningful alternative provider of guarantees with the differentiating benefit that they do

not require collateral and are competitively priced. In addition, they do not take up bank financing lines, and

preserve a valuable source of funding.

Sales Management and Strategy

1. Valuable Sales Tool to Drive Growth

In a competitive B2B market, sales teams with the option to offer deferred payment terms can gain a critical edge in

winning new business and securing existing client relationships. With a funded credit solutions program, portfolio

companies can avoid the adverse cash flow impact of deferring their receivables and accelerate their cash conversion

cycle by monetizing those receivables.

More importantly, it equips the front-line sales force with a valuable tool to help meet aggressive revenue targets

without sacrificing working capital.

2. Support Market Expansion

Entry into new geographies or new customer segments is often a strategic priority for portfolio companies in the

value creation journey. The tactical use of credit risk insurance can de-risk market entry by giving confidence to

transact with new customers that may be further down the credit spectrum, or ones that are based in new countries.

Conversely, concentration risk on large existing customers can be managed by insuring their receivables to safeguard

revenue quality.

3. Access to Credit Risk Data and Analytics

Partnering with credit insurers can allow firms to leverage a deep global pool of credit risk data and analytics.

Credit quality ratings on customers can provide valuable insights and be a useful tool in business planning

processes.

In fact, credit insurance coverage coupled with advice from insurers can be a critical resource of data for credit

control teams and provide decision-making support in managing the receivables book and payment terms. For smaller

portfolio companies, it may even allow for a leaner credit control function and deliver longer-term costs savings.

Procurement and Supply Chain

1. Build Supply Chain Resilience

As many firms continue to reconfigure supply chains, the use of supply chain finance and similar payables financing

solutions is an opportunity to develop resilience in the supply chain by providing suppliers a valuable source of

liquidity. Credit solutions can enable supply chain finance and potentially lower the financing charges that lenders

require to offer these programs.

The implementation of these structures often provides an opening for the Procurement function to extend or harmonize

payment terms which delivers a working capital boost. It can also lead in a broader review or negotiation of

supplier contracts which can create procurement efficiencies for the portfolio company.

2. Leverage the Credit Value Chain

Portfolio companies without a sufficiently high credit rating to anchor their own supplier financing programs can

explore opportunities within their credit value chain.

Firms can partner with their credit solutions advisor to directly engage the insurance market and build new credit

insurance capacity on their own credit risk. New insurance capacity created through a ‘reverse credit’ exercise can

be introduced to key suppliers and potentially enhance future commercial negotiations. This is especially powerful

for companies that have recently entered private ownership (i.e. through a private equity purchase) or those that

can credibly demonstrate a turnaround story and highlight financial and operational improvements recently achieved.

Companies should also investigate upstream opportunities on the credit value chain such as whether their larger

customers have existing payables finance programs and attempt to get onboarded.

Across the various functions of the portfolio company, whether it is corporate treasury, sales, or procurement,

credit solutions can be a meaningful tool to optimize working capital and support broader initiatives to deliver

sustainable revenue growth and create new operational efficiencies.

With the increased use of credit insurance capital by private equity firms, the use of credit solutions is

increasingly an integral part of value creation plans and a critical working capital optimization tool for portfolio

companies.

Driving value across the private equity investment lifecycle

Credit solutions can meet a range of strategic objectives across private equity investment lifecycle.

1 Aktas, Nihat and

Croci, Ettore and Petmezas, Dimitris, “Is Working Capital Management Value-Enhancing? Evidence from Firm

Performance and Investments.” Journal of

Corporate Finance, 2015.