While data and analytics are critical in nearly all aspects of risk management and risk transfer, they are especially

vital to parametric insurance — and as technology improves, parametric is becoming a more viable and accurate

solution for risk buyers.

Unlike traditional cover, parametric is triggered by predetermined third-party parameters — such as a windstorm

category within a set geography — rather than an actual loss. The upside is faster payouts without the need for

time-consuming assessments and a complementary solution that helps fill the protection gap.

In the face of rising natural catastrophe losses due to climate change, a continued hard property insurance market

and growing protection gaps, more risk managers are seeing parametric as a complement to their property risk

portfolio. This is particularly true when it comes to natural catastrophe exposures, and the ability to make

uninsurable risks insurable.

Better Informed

Data Advancements as a Key Growth Driver

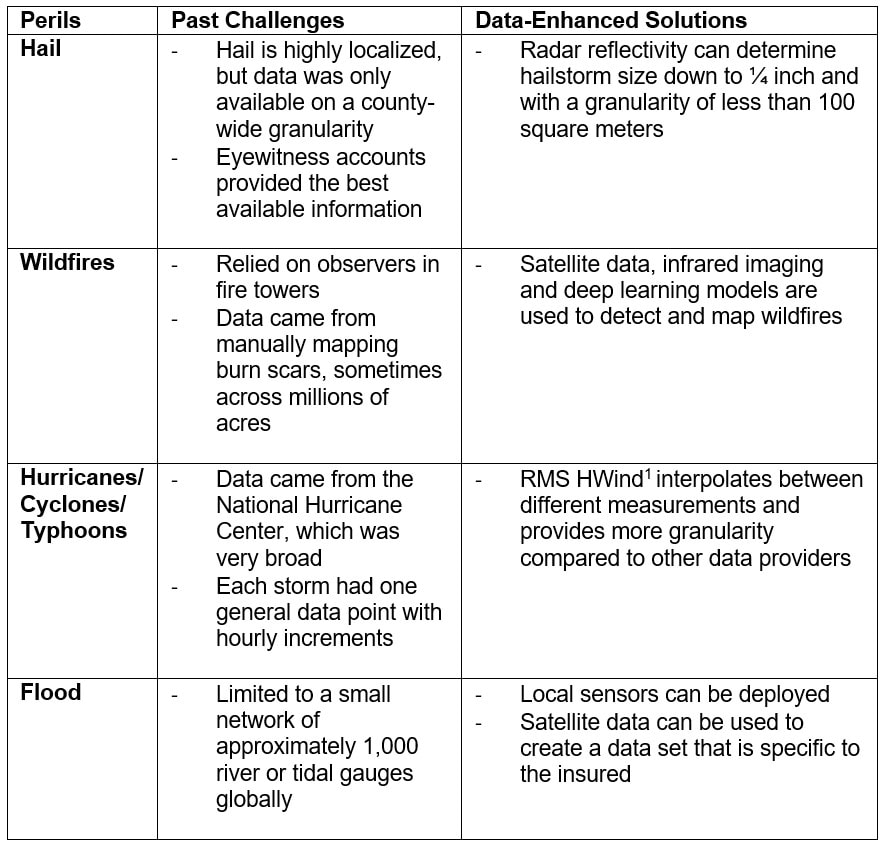

Carriers need to know the likelihood of a loss event to underwrite parametric insurance. They also need to know the

precise location and severity of the event to issue claims payments. While past imprecise data caused obstacles,

advancements in technology have transformed the parametric market.

“It's important that a parametric triggers when you feel loss pain, but it's equally important that it doesn't

trigger when you don't feel pain,” says Peter Lacovara, a managing director in the Alternative Risk Solutions

practice at Aon. “The greater precision we can use for structuring, the closer we can get to proxying exactly what

you want to cover without paying for anything unwanted.”

With access to advanced data analytics and risk models, as well as a wealth of triggering data from weather stations,

seismic sensors and financial markets, insurers are now in the perfect position to expand their parametric programs

for risk managers.